These are grim times for much of the television business: Netflix’s historically awful April has prompted somber talk about whether there are too many platforms charging consumers too much money and churning out too much TV. But not every quadrant of the streaming universe is suffering an existential crisis. At this week’s annual digital-industry schmoozefest known as NewFronts, free ad-powered services Tubi, Roku Channel, and the newly rebranded Freevee staged elaborate in-person presentations to show off aggressive slates of increasingly ambitious original content and brag about their rapidly rising viewership numbers. If you closed your eyes, it almost felt as if you were back in the good old days of 2021.

The players in this second tier of budget streamers have been around for years but have never gotten anywhere near as much attention as the big guys: They’ve generally been regarded as a sideshow within the much bigger streaming wars. But as audiences make it increasingly clear they’re not going to keep paying higher rates for every new subscription service that comes along — or even established ones such as Netflix — platforms that aren’t as reliant on monthly fees could start grabbing a bigger slice of audiences’ attention. Amazon clearly thinks so: Even though it has one of the most mature subscription TV products out there with Prime Video, it has been heavily investing in Freevee (and its predecessor, IMDb TV) for a couple of years now. It even decided to take a spinoff of one of its most successful originals ever (Bosch) and put it on its no-cost service. (Of course, because Freevee is fully integrated into Prime Video, many viewers won’t even realize the difference — until the action on Bosch: Legacy is interrupted by commercials.)

The (potentially) worrisome news for ad-supported streamers is that the low-cost streaming game is getting increasingly crowded. Disney+, already one of the cheaper ad-free streamers at $8 per month, is planning to introduce an ad-supported tier this fall. And in the biggest earthquake to ever hit the streaming ad business, Netflix finally gave in last month and said it plans to offer a lower-cost level of service with advertising, joining rivals Hulu and HBO Max in offering audiences a less expensive option supported by commercials.

These new lower-cost plans obviously won’t be direct competitors with the Tubis and Freevees because they’re still far from free. But Disney+ and Netflix will now be aggressively looking to scoop up advertising dollars and will be flooding the market with a huge amount of new ad-time inventory. The history of TV suggests the advertising pie is hardly finite, and the explosion of cable services in the 1980s and 1990s didn’t cause a collapse in the broadcast-TV ad business. But if the move of Netflix and Disney into the lower-cost space does what it’s supposed to do — reduce churn and even spur new sign-ups — then in theory, that means the budget streamers will have to work even harder (and spend even more) to drive up the numbers of hours consumers spend on their platforms.

And based on what I saw during this week’s NewFronts, it’s clear the ad-supported streamers are not slowing down in their efforts to ramp up the size and quality of their original offerings. Some quick impressions of what they’re planning:

Tubi

The Fox-owned free streamer used its presentation to reaffirm its commitment to dramatically expanding its originals slate, confirming plans to roll more than 100 first-run titles (series, specials, and movies) over the next year. It also talked up upcoming movies such as Cinnamon (starring Damon Wayans and Pam Grier) and a remake of 2002’s J. Lo vehicle Maid in Manhattan. But overall, Tubi didn’t provide a ton of details, saying only that it would be leaning on sister companies such as animation powerhouse Bento Box, TMZ, and the recently acquired MarVista Entertainment to produce new programming.

Tubi also officially announced something users of the service had noticed in recent months: The platform, which began as a strictly on-demand service, is now moving into the live-channels business in a big way. Having added live local news and sports feeds last year, Tubi is now in the process of adding dozens of virtual channels devoted to entertainment programming, including single-title channels for properties such as The Masked Singer, The Dick Van Dyke Show, and Cosmos.

The Roku Channel

If your only metric is social-media buzz, then Roku easily won NewFronts week thanks to its release of a one-minute teaser trailer for Weird: The Al Yankovic Story. The first look at Daniel Radcliffe as the pop music icon set Twitter ablaze Tuesday and tallied up more than a million YouTube views within 24 hours between Roku and Yankovic’s respective accounts. That’s a regular occurrence for Netflix or HBO Max, but for a nascent supplier of original content, the response to Weird was off the charts — and sure seems to be bigger than any previous Roku original (including the shows it acquired from Quibi). It’s just one title, but if Weird ends up actually being good, it could be a turning point for the platform, which has started showing signs of slowing growth lately.

Roku also pulled out all the stops to convince advertisers it was serious about growing its portfolio of originals, particularly on the foodie front: The streamer announced new projects from Martha Stewart, Emeril Lagasse, and Christopher Kimball, as well as deals bringing past episodes of their former series to the platform. There wasn’t much news on the scripted front, as deals heralded as “new” by the platform — a second season of Kevin Hart’s Quibi show Die Hart; the Zoe Lister-Jones comedy Slip — were announced weeks or months ago.

Overall, Roku still appears to be moving more cautiously than Amazon’s Freevee or Peacock in terms of big-budget scripted shows, instead focusing on output deals (like one to bring Lionsgate movies to the service) or strategic alliances (The Wall Street Journal this week reported Roku wants to take a minority stake in the Starz cable channel, which is owned by Lionsgate.) But given it’s the default streaming device for so many U.S. viewers, Roku is clearly still poised to be a key player in the battle of the budget streamers.

Freevee

The Amazon-owned streamer formerly known as IMDb TV has been positioning itself as the “modern TV network,” and apparently that applies to how it handles advertiser presentations. There were some serious late aughts NBC vibes to the Amazon-slash-Freevee presentation Monday, from the presence of Amy Poehler as wisecracking host to showrunners awkwardly appearing on stage with their cast to tout their new projects. It wasn’t flashy or sexy, but based on what I saw, it actually kinda worked. Writer Greg Garcia showed off a first look at his upcoming Freevee comedy Sprung, and — this is a compliment— it felt indistinguishable from his past shows for NBC (My Name is Earl) and Fox (Raising Hope). Just like at a traditional network, Freevee execs talked up a spinoff of a high-profile hit, in this case, Bosch: Legacy (which premieres Friday). And there was a themed sizzle reel set to a bouncy pop tune (appropriately named “Free”) that showed off the entire offering. Unlike Tubi and Roku, which still feel as if they’re getting their original programming sea legs, Freevee felt fully formed.

But even if I found Freevee’s slate the most interesting, the Roku and Tubi presentations still showed off businesses light-years ahead of where they were just a couple of years ago. As in the early days of basic cable and subscription streaming, the free streamers were until very recently little more than repositories for reruns and old movies with just the most basic level of curation. They’re still very much in the business of aggregating what you might call “gently used” content, but this week showed that these platforms are maturing quickly. I can see projects like Weird and Sprung breaking through the pop-culture clutter, while I’d be shocked if Bosch: Legacy isn’t a big hit. It’s clear the companies behind the free streamers very much see an opportunity to snatch up viewers who’ve fled the cable bundle. What’s more, with inflation at a 40-year high and consumers pinching pennies all around, the timing couldn’t be better for free services to step up with programming that doesn’t seem cheap.

Peacock’s Fancy (and Kinda Spooky) New Ad Gimmicks

The week’s other big presentation during NewFronts came from Peacock, which lives somewhere between the totally free streamers and premium subscription services. While a subscription is required to watch almost all original content on the service, most consumers either get that subscription for free as part of a cable or internet plan or they pay a relatively modest $5 per month for an ad-supported option. That makes advertising a huge part of Peacock’s profit equation and explains why execs spent a decent chunk of their NewFronts appearance touting new methods the service is rolling out to put advertising messages in front of subscriber eyeballs.

One of Peacock’s innovations is something called “frame ads,” in which viewers will find whatever content they’re watching suddenly surrounded by static images of a sponsored sales pitch for a few seconds — a popular brand of ice cream or a new entrée at Applebee’s. The frame ads will sometimes be interactive, serving up a link to, for example, summon a delivery service to bring you whatever calorie-laden creation Applebee’s has concocted this month. If it sounds disruptive to the viewing experience, well, that’s sort of the point: As competition for ad dollars heats up, platforms will be looking for new ways to make advertising more effective.

That’s also why Peacock made a big deal out of what it’s calling the “in-scene ad,” which is just a fancy way of describing product placement taken to near Minority Report levels. It basically lets companies not only digitally insert new product images into existing programs — something that had been around for over a decade — but target what exactly gets plopped into a scene according to where you live or what kinds of products the Peacock algorithm thinks you might be interested in purchasing. So while John from Cincinnati might see a bag of Skittles as he’s watching a rerun of The Office, Sue in Pasadena could see an image of a pint of Ben & Jerry’s while streaming the same episode at the same time. Peacock isn’t alone in this innovation: Amazon showed off a similar technology during its presentation this week — they call it “virtual product placement” — and said that it’s already been beta tested with series on Freevee and Prime Video.

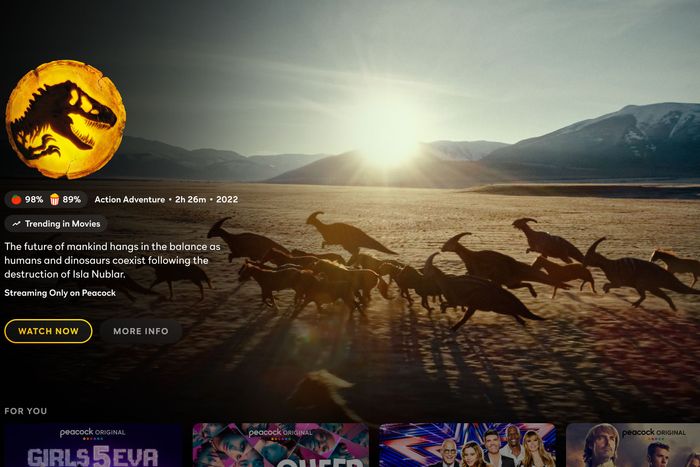

Beyond its new advertising options, Peacock also touted plans to modestly upgrade its user interface, which was not particularly attractive when the platform launched in 2020. Subscribers will soon be seeing a vertical navigation menu on the left side of the screen (finally), while the browsing experience is being spruced up with bigger images, video, and tools designed to make it easier to start playing a specific title while scrolling.

Meanwhile, on the programming front, Peacock will now carry next-day episodes of all in-season Bravo originals, mirroring the recent news that the service will become the exclusive home for next-day NBC episodes starting this fall. And while we already knew Peacock sibling studio Universal Pictures would be producing original films for the platform, on Monday, the streamer announced the first three projects to come from the arrangement, including an English-language remake of John Woo’s The Killer that will be directed by … John Woo.