Corporate earnings calls are usually pretty low-key affairs of interest only to Wall Street analysts and reporters who cover a particular industry. So it was very much not normal when last weekÔÇÖs Warner Bros. Discovery second-quarter financial-results report somehow became a trending topic on Twitter and the subject of some seriously over-the-top ÔÇö and flat-out false ÔÇö rumors about the fate of HBO Max. But while the most panicked pronouncements about what was going to unfold didnÔÇÖt come to pass, that doesnÔÇÖt mean everything is back to normal at the company. In fact, the darkest days are right around the corner.

As multiple outlets have already reported, and Vulture has confirmed, Warner Bros. Discovery will very shortly begin the process of laying off hundreds (and likely thousands) of staffers at all levels of the company. ItÔÇÖs a completely unsurprising development, one that was all but guaranteed the moment the Justice Department signed off on the marriage of WarnerMedia and Discovery Networks. With so much debt on the books at the time of the merger (more than $50 billion) and more than a few overlapping units on the TV side (ad sales, tech, unscripted programming), what corporate types soullessly refer to as ÔÇ£streamliningÔÇØ meant countless loyal and qualified employees were going to be handed pink slips. The same thing happened a few years ago when Rupert Murdoch sold off most of his 20th Century Fox assets to the Walt Disney Co., and entire divisions and studio-production labels simply vanished under the watch of Robert Iger.

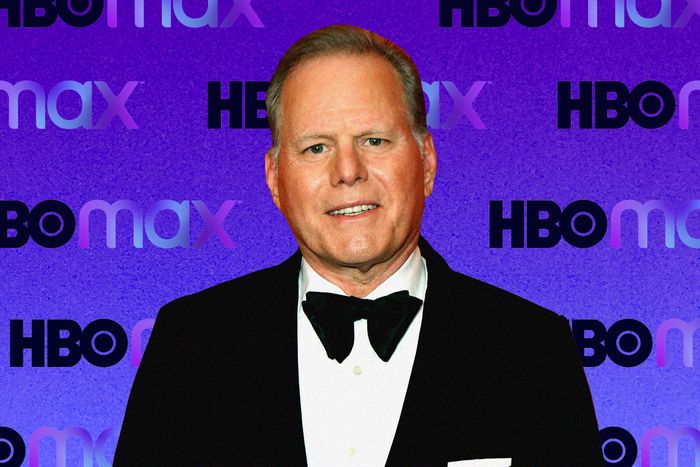

But the overall pain at Warner Bros. Discovery may end up being even more severe. While there are far fewer overlapping divisions, and thus fewer duplicative jobs, company CEO David Zaslav and his chief financial officer, Gunnar Wiedenfels, have been telegraphing plans to slash $3 billion from the new companyÔÇÖs bottom line within two years. ThatÔÇÖs a huge number, and yet it now seems likely Zaslav and Wiedenfels will have to find even more cost savings. The reason: The Great Netflix Correction of ÔÇÖ22.

For all the Schadenfreude this spring over the digital giantÔÇÖs well-documented woes, it turns out that when Netflix sneezes, the rest of the streaming industry catches a cold. And so the same Wall Street overlords who have decided that, actually, no, itÔÇÖs not okay for Netflix to pile on endless debt in order to finance its streaming ambitions are applying the same rules to all the other companies trying to manage the transition from linear TV and the cable bundle to the new streaming universe. This is why Warner Bros. Discovery, Disney, and Comcast have all seen their stock prices come way down over the past six months or so, even if theyÔÇÖre doing better than Netflix. ÔÇ£The world changed because of what happened with Netflix,ÔÇØ one industry wag says. Absent a road map for profitability, ÔÇ£you canÔÇÖt just spend $20 billion on content anymore.ÔÇØ

During last weekÔÇÖs earnings call, Zaslav all but conceded he would be looking to cut more than the originally planned $3 billion. ÔÇ£WeÔÇÖve been able to dig deeper into the financials and have gained a much better, more complete picture of where we are and the path forward, including identifying some additional and unexpected challenges that have and will continue to require our focus and attention,ÔÇØ he told analysts. ÔÇ£The upside is that there is even more room for improvement in cost savings.ÔÇØ

Of course, what Zaslav calls an ÔÇ£upsideÔÇØ will not feel like that to the employees about to lose their jobs. WhatÔÇÖs more, his direct reports are now figuring out how to cut expenditures at most levels of the company, including certain kinds of content (though probably not overall content spend). So in addition to moves like the much-covered mothballing of Batgirl ÔÇö which will save hundreds of millions of dollars once unrealized marketing expenses are factored in ÔÇö┬áexpect to see more headlines similar to those we saw last week, when news broke that HBO Max had been quietly clearing its digital shelves of little-watched library content, including some titles just a few months old.

It wasnÔÇÖt smart of the streamer to do this housekeeping in the shadows since it allowed all sorts of internet conspiracy theories to flourish; a quick Friday-afternoon press release explaining the action would have resulted in far less social-media pain. But leaving aside the optics, tidying up the library is an understandable strategy now that the era of ÔÇ£spend now, pay laterÔÇØ is officially over in streaming. While HBO (or more precisely, Warner Bros. Discovery) owns culled shows such as Vinyl and Camping, it still costs money to make such one-season series available for on-demand viewing, thanks to deals with profit participants and residual payments. The price may be tiny compared to, say, an in-demand show such as Friends, but if hardly anyone with access to HBO Max is streaming the show, the cost per viewer becomes exponentially higher. And the total outlay ÔÇö┬áparticularly when some onetime accounting tricks related to the merger are factored in ÔÇö almost surely adds up to tens of millions of dollars when you tally the collective savings. (A Warner Bros. Discovery rep declined comment on the amount of cost savings involved.)

Early on, streamers like HBO Max didnÔÇÖt worry about such relatively small line items, because it was much more important to be able to sell consumers a robust offering: ÔÇ£10,000 shows! 50,000 hours of content!ÔÇØ Plus, newer platforms didnÔÇÖt yet know for sure how less high-profile shows (read: failures) would perform in the algorithmic world of streaming. In theory, certain titles could have broken out in digital the way some movie flops used to become hits when they migrated to home video or basic cable. But the shows HBO Max axed from its digital library didnÔÇÖt do that, so it isnÔÇÖt entirely surprising that, under pressure to cut costs, Warner Bros. Discovery execs decided the money being spent to keep them around would be better used on newer titles (or simply saved altogether).

Still, shrinking a relatively new platformÔÇÖs catalog also is not the most consumer-friendly development: Less is never more for audiences, no matter how much critics (and some execs) complain about ÔÇ£clutterÔÇØ on streamers. WhatÔÇÖs more, deep content libraries represent one of the few legs up platforms tied to legacy media companies (HBO Max, Paramount+, Peacock) have over the upstarts from Silicon Valley like Netflix. Mrs. Fletcher and The Witches might not be titles tons of folks will miss, but theyÔÇÖre ones which no other service can offer ÔÇö and now theyÔÇÖre generating virtually no value for Warner Bros. Discovery other than a short-term boost to the companyÔÇÖs earnings statement.

Similarly, last weekÔÇÖs quietly delivered news that Baz LuhrmannÔÇÖs sleeper hit Elvis would be the first Warner Bros. movie since Wonder Woman 1984 to not stream on HBO Max within 45 days of hitting theaters is another example of de-emphasizing subscription streaming in favor of, well, cash. The movie has instead been made available this week for digital purchase or premium rental; thereÔÇÖs no official word yet when it will hit HBO Max. But other big Warners movies will travel a similar path: A spokesman for the platform tells Vulture that streaming premiere dates for Warners films will now be evaluated ÔÇ£on a case-by-case basis.ÔÇØ Elvis will still stream on HBO Max, and likely within a month or two, but what had been a big point of differentiation for HBO Max ÔÇö new movies six weeks after hitting theaters ÔÇö has now been blurred.

This sort of prioritization of near-term profits isnt inherently catastrophic, but it is a big reversal from recent thinking  and very much in keeping with how Zaslav (and CEOs of most traditional media companies until recently) have operated for years. The Netflix correction may be prompting even more cutbacks, but as industry analyst Rich Greenfield of LightShed put it Wednesday in a letter to investors, Warner Bros. Discovery is effectively going back to the pre-AT&T strategy playbook  If you no longer believe you can be a clear leader/winner in streaming, you need to change strategies. He cites some of the companys other big moves of late  including the decision to once again let Amazon sell HBO Max in its channels store, even if it means giving up a direct relationship with consumers  as evidence of the shift in thinking. The harsh reality is that WBD has no choice. As their huge basic cable network portfolio erodes at an accelerating rate along with the rest of the legacy media industry, WBD needs to find new ways of generating cash, even if that means sacrificing their future strategically.

Some in the industry will welcome this, of course, as a return to ÔÇ£sanityÔÇØ after WarnerMedia leadership decided to take temporary hits in order to build an effective direct-to-consumer business, a path previously plowed by Iger at Disney. Given NetflixÔÇÖs woes of late, it is not absurd to believe Zaslav is being prudent in going back to basics. But it is worth considering that, while such a course is clearly safer than doubling down on direct-to-consumer, it also risks getting left behind if and when the linear TV ecosystem completely collapses.

Whatever the long-term implications, at least for now, Zaslavian caution seems to be winning the day in streaming, and not just at HBO Max. Even Netflix has made it clear it plans to change the kinds of content investments it makes, which could lead to it getting out of the business of making certain kinds of shows. Its strategic shifts are obviously much different than whatÔÇÖs going on at Warner Bros. Discovery, but it is clear┬á we have now moved out of the launch phase of the streaming era and into the age of trying to make these platforms work. By necessity, streamers are going to be a lot more judicious about how they spend their money and what kinds of shows they program.

And yet, even if we are in for some bumpy times, and even if HBO Max is evolving quickly under new corporate governance, the apocalypse-now scenarios regarding the streamer that played out last week on social media ÔÇö and even in some publications ÔÇö now seem to be pretty clearly detached from reality. Despite wild speculation about HBO MaxÔÇôbranded shows going away, or HBO being minimized on a rebranded Warner Bros. Discovery streaming platform, multiple people in a position to know have told me that is simply ridiculous.

For one thing, Sarah Aubrey, the well-respected industry vet who runs the Max originals team under Max content chief Casey Bloys, is said to be in zero danger of losing her job. In this age of employees everywhere suddenly deciding to make big career changes, it probably isnÔÇÖt wise to make ironclad pronouncements about where any exec will be in six months. But Bloys and Warner Bros. Discovery execs have full confidence in her, multiple sources familiar with the situation say. Similarly, there are too many scripted areas vital to HBO MaxÔÇÖs future ÔÇö shows based on Warner Bros. IP, genre programming, super-niche comedy ÔÇö that donÔÇÖt make sense for the ÔÇ£Classic HBOÔÇØ development team, if you will, to handle. AubreyÔÇÖs team could well be impacted by the coming layoffs, just as there could be changes on the HBO side of things. But Warner Bros. Discovery has no plan to cut back scripted content to only traditionally HBO-branded shows, or to significantly cut back on scripted programming as a whole.

What will change, however, is the content mix of HBO Max originals. As has been widely reported, the unscripted division at the streamer is likely to be eviscerated as the platform leans on reality content from Discovery Network, as well as the execs who already work on that side of the company. As part of ZaslavÔÇÖs overall lowered expectations for streaming, Warner Bros. Pictures isnÔÇÖt going to be making $100 millionÔÇôplus movies just for HBO Max either (though HBO will continue, as it always has, to make a handful of smaller movies every year). And there could be other adjustments in the programming blend as well, though exactly what that means is still very much up in the air, industry insiders say.

Equally unclear is what the platform currently known as HBO Max will be called a year from now. Last spring, Warner Bros. Discovery execs clearly stated they planned to create a single service combining Max and Discovery+, and as Vulture reported in June, this supersize offering may well get a new name. In the haze of last weekÔÇÖs rumor-a-rama, some interpreted this as a sign Team Discovery was looking to minimize HBOÔÇÖs role going forward. But as Zaslav himself made clear on the earnings call, he considers HBO the ÔÇ£crown jewelÔÇØ of the new company, so those reports are, as our current president might say, pure malarkey.

From all reports, the company is still actively debating the best branding for the new super-service. As noted here two months ago, the HBO name carries little to no equity in many of the dozens of countries where HBO Max has yet to launch. WhatÔÇÖs more, with thousands of hours of Discovery content expected to be added to the platform by next summer, rebranding could offer a way of signaling to consumers whoÔÇÖve so far resisted the lure of HBO Max that the app is an even better value proposition. Whatever path the company decides on, thereÔÇÖs a good chance the decision will be announced at or just before an investorÔÇÖs day conference it plans to hold just before yearÔÇÖs end.