Streaming platforms don’t live or die on the strength of an individual show or movie, but one project can make a huge difference. Netflix, for example, was taken a lot more seriously as an original programmer after Orange Is the New Black emerged as a pop-culture phenom in July 2013, proving earlier buzz for House of Cards was not a fluke. Prime Video had a similar breakthrough in 2017 with the arrival of The Marvelous Mrs. Maisel, while more recently Apple TV+ found pop-culture salvation through the gospel of Ted Lasso. Now, Roku is poised to have its own moment of validation thanks to a very unlikely recruit in the content wars: “Weird Al” Yankovic.

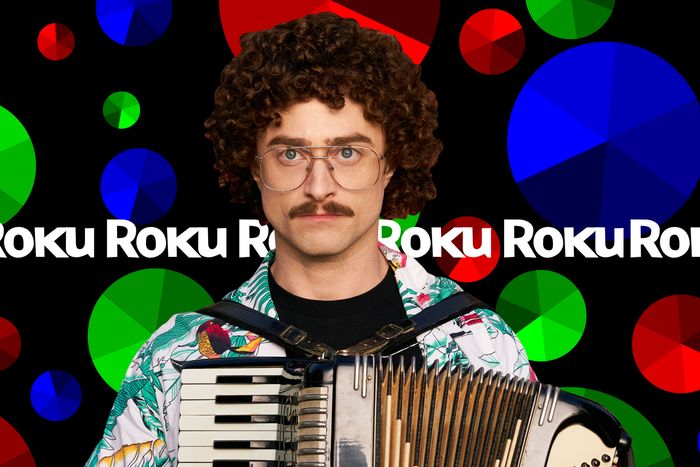

On Friday, the company best known to consumers for its inexpensive streaming devices and an ubiquitous OS embedded in millions of smart TVs will unleash Weird: The Al Yankovic Story, a comedic biopic in which Daniel Radcliffe stars as the iconic music parodist and entertainer. The 108-minute film will stream for free via Roku’s ad-supported platform, The Roku Channel, and while a made-for-TV movie with a reported $12 million budget doesn’t merit much attention these days, Weird is shaping up to be more than just another tile tossed into the Too Much TV programming mix. Since first being announced in January, the Funny or Die–produced pic has generated a steady drumbeat of media coverage, which then turned into positive reviews when it hit the festival screening circuit in the fall. Even before a single minute of viewing time is tabulated, Weird arguably ranks as the most successful project in the two-year history of Roku Originals, at least as measured by buzz.

That’s a big win for Roku, which long ago moved on from its early focus of making devices and providing an easy-to-use operating system for cord-cutting consumers. While the company still very much wants to sell you a Roku player, it is now far more interested in getting you into its own streaming ecosystem and how much time you spend there. That’s because the more time you’re in Roku’s world, the more opportunities the company has to monetize your streaming through its key revenue streams:

➽ Advertising partnerships: Because it essentially acts as a sort of digital cable company, Roku gets a cut of whatever ad revenue companies such as Paramount Global or Fox generate when people watch free streaming services such as Pluto TV and Tubi within the Roku OS. But since 2017, Roku has also been getting money directly from advertisers with its own free streamer, The Roku Channel. In addition to licensing old reruns and movies from various Hollywood studios and selling ad time against on-demand viewing, Roku Channel also works directly with third-party partners to distribute so-called FAST linear feeds within Roku Channel, bringing in even more cash.

➽ Originals: Early last year, Roku decided to, as it put it at the time, “opportunistically” get into the business of making its own original titles for Roku Channel. It did so in a rather splashy way, acquiring the programming assets of the short-lived mobile streamer Quibi and turning them into Roku Originals. That instantly gave the service dozens of exclusive titles to pitch to advertisers and, more importantly, much-needed insights into what sort of original content might work best with audiences. It also made a deal to finance a Christmas movie continuation of the canceled NBC musical drama Zoey’s Extraordinary Playlist and bought the company behind PBS staple This Old House in order to put new episodes on the platform.

➽ Subscriptions: In another echo of the cable ecosystem, Roku also gets paid whenever it convinces its users to subscribe directly to paid streamers such as Britbox, Shudder, or Topic. While Netflix and HBO Max don’t really need much help getting people to check out their wares, smaller streamers have come to rely on the Roku, Apple TV, and Amazon’s Fire TV platforms to help generate a significant number of sign-ups.

Much the way Netflix execs like to talk up their “virtuous cycle” of spending, Roku views its content and advertising business as a “flywheel,” according to Rob Holmes, VP of programming for Roku. “By being able to bring in great content for our users, we can generate a large volume of users, and we then have this really significant scale that makes us appealing to advertisers,” he says. “Advertisers ultimately know that people are leaving linear television, and they want to be able to reach those audiences to be able to promote their products. That combination then drives our monetization and allows us to continue to invest in content.” Nobody at Roku claims to be reinventing the wheel (or the flywheel), but they do believe the strategy is working.

Reporting its third-quarter earnings Thursday, the company said it now has more that 65 million active accounts (up 16 percent from a year ago) and that time spent streaming on the platform has jumped 21 percent within the past year, to just under 22 billion hours. Obviously Roku doesn’t make money from most of those hours: Lots of the increase is on platforms such as Netflix and thus isn’t directly monetizable. But viewing on the Roku Channel is rising quickly, jumping over 90 percent. Roku Channel is also starting to expand outside the U.S. and Canada: The service became available to viewers in Mexico last month, bolstered by content from local networks such as Telefórmula.

Holmes says the originals on Roku Channel represent “the top of the pyramid” when it comes to the content focus of the service and have been responsible for a big chunk of its surge in viewership. But just as importantly, programming like Weird helps Roku command higher prices from advertisers, who’ve historically been willing to pay a premium for first-run and exclusive content. While Roku is not immune to the turbulence facing the overall video ad market — demand is cratering as companies prepare for a possible recession — the company says it continues to see increases in its overall revenue. Indeed, during last spring’s advertising upfronts, Roku booked more than $1 billion in advanced commitments for the first time ever.

But while the company clearly wants to be in the originals game, at least for now Roku seems to have no desire to compete with either paid streamers such as Hulu and Peacock, or even match the output and production budgets of free streaming rival Amazon’s Freevee. “We’ve had to be very strategic about where we invest,” Holmes explains. The most high-profile projects it has green-lit have tended to be movies (Zoey’s, Weird) or lower-cost comedies from the Quibi library (a new season of Die Hart), as well as unscripted fare (Chrissy’s Court, The Rich Eisen Show) — in other words, nothing that is going to be compared to House of the Dragon. Company execs have repeatedly talked about making sure their content spend is appropriate to how much revenue the company is, or expects to, generate in the near-term. That means not going billions of dollars into debt as Netflix did early on in order to gain more subscribers.

Instead, Roku seems to be thinking of originals as a way to get viewers into its broader ecosystem. Someone who comes to Roku Channel for Weird will find a slew of ’80s movies and TV shows which might satisfy their nostalgia craving; if they’re lured by the three new Martha Stewart specials Roku plans this fall, they’ll discover tons of episodes from her past shows. “We can offer them a selection of unique and exclusive content including originals — which is compelling for them and for advertisers — but we’re also trying to help them find content to watch when they’re just looking to watch something on television,” Holmes says. “And the fact that it’s free makes it a very compelling value proposition.”

As for Weird, Roku has been masterfully milking every new morsel of information about the project for maximum marketing effect, getting the sort of media attention normally reserved for projects on much bigger platforms. Its job has been made easier by the fact that the movie has two generational icons at its center: Yankovic is a hero to Gen-Xers who grew up on his videos and albums, while Radcliffe is beloved to millennials (and their parents) for the Harry Potter movies. But because Roku is not out there premiering a new show or movie every week — or even every month — its marketing team was also able to laser-focus on building anticipation in a way that most other streamers could not. That includes treating Weird like an Oscar contender by having it make the rounds on the festival circuit — even though the company is very clear any awards-season campaigning will happen on the TV side. “The film is meant to be watched on television, and we are really excited to concentrate on TV for whatever awards or nominations people may grace us with,” Roku Originals chief David Eilenberg says.

Roku’s focus on making sure Weird became a buzz magnet for the company even extended to decisions it made regarding the film’s production. While most modestly budgeted movies for streaming look to keep costs down by shooting in Canada or some other area with lower production costs, Roku agreed with Funny or Die’s desire to have the movie shoot in Los Angeles. Even if it made the movie a bit more expensive, “that allowed for anybody and everybody who might want to do a cameo to come swing by, and that’s indeed what happened,” Eilenberg explains. “The comedy community and so many people have so much love for Al that it just sort of started to snowball from there.” The result: Weird is overflowing with bold-faced names (Quinta Brunson! Jack Black! Conan O’Brien!), all of whom have already helped boost social chatter about the film.

While Roku’s content flywheel strategy seems to be on solid footing, the company’s overall situation right now is not quite as rosy. Like so many other new media companies this year, its stock has taken a battering. Even if it’s not reliant on growing subscription numbers like Netflix, it has felt the pressure from the rising uncertainty about the overall economy and consumer spending. In an investor call Wednesday, Roku founder and CEO Anthony Wood said he was already seeing advertisers pull back on their budgets, which is likely to hurt Roku’s bottom line, too. “Big advertisers that we traditionally get spend from are not spending this quarter,” he said. “They aren’t spending with anyone. It’s not just they’re not spending with us.”

What Roku is counting on, however, is that free streaming will only continue to explode in popularity as consumers grow ever more wary of the rising costs associated with subscription streaming. All the major SVOD platforms except for HBO Max have announced or implemented price hikes within the past year, and that could cause consumers to spend more time with free streamers like Roku Channel.

Meanwhile, in perhaps the clearest signal yet that Roku is committed to its ad-supported originals strategy, the company recently snagged respected TV industry vet Charlie Collier to come on board as president of Roku Media, a gig which includes oversight of the Roku Channel and the company’s advertising business. It’s a big get for Roku given Collier’s background and track record: He helped transform AMC Networks into a basic cable powerhouse during the 2010s, then spent the last four years successfully guiding Fox through its transition into a smaller, nimbler company following Disney’s purchase of its sibling studio. Collier knows the advertising world well (he oversaw ad sales for Court TV in the mid-aughts), and gained first-hand knowledge of the ad-supported streaming model over the past two years after Fox bought Roku Channel rival Tubi.

Collier’s first day on the job at Roku was Monday, and he understandably isn’t yet giving interviews. For now, however, Holmes and Eilenberg are continuing with their recent strategy of building Roku Channel with a mix of strategic investments in library content (like a recent deal to stream the Adult Swim Festival concert event and select AS-branded titles such as Joe Pera Talks with You and season one of Tuca & Bertie) and a handful of originals. The platform’s 2023 slate includes The Great American Baking Show (from the company behind the original British format), a new season of Nasim Pedrad’s canceled TBS comedy Chad, and a scripted half-hour called Slip starring Zoe Lister-Jones (Life in Pieces).

One thing Holmes feels safe ruling out, at least for now, is any change from Roku’s core strategy of keeping all of its original and acquired content in front of any paywalls. “Right now the power of free is really the engine behind the growth of the Roku Channel,” he says. “We’re going to launch this movie [Weird], which has got a lot of buzz, and anywhere else there would be a variety of different windows, and models, and things that we’d move through before eventually it becomes available with ads sometime down the road. For us to be able to bring even this, our most premium and buzziest content, to our users for free on day one is, I think, really compelling.”

And while it might be tempting to offer an ad-free option and snag some of those sweet subscription dollars, at this stage Holmes believes it would just muddy the Roku Channel brand. “We could re-evaluate it down the road, but I just think that ‘free’ is a great message for our users and it works very well for advertisers, too,” he says. “They understand they’re always going to get our best content, not the thing that they didn’t put on the SVOD service.” And while that might annoy some viewers who are just completely allergic to advertising, Roku is betting that part of the audience is vastly outnumbered by folks who’ve grown tired of being nickeled-and-dimed by streamers. The psychology of ad-supported streaming is “very different for consumers,” Holmes says. “Maybe it’s not something they would’ve paid ten bucks a month to subscribe for, but they’re very happy watching it. … And it doesn’t cost them anything when they’re not.”