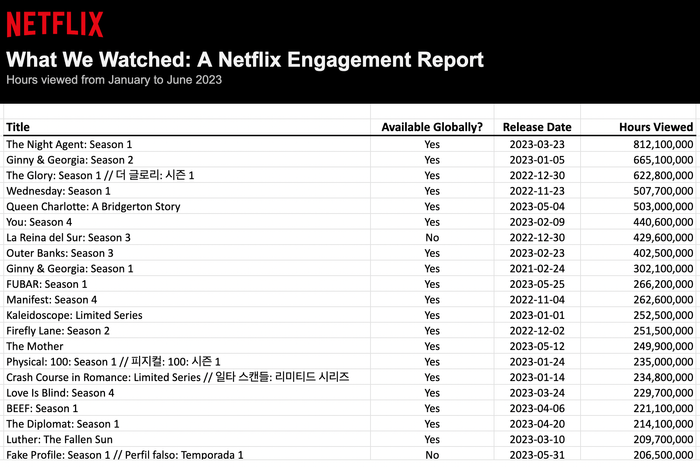

Netflix took a major step toward viewing-data transparency Tuesday, revealing audience consumption numbers for nearly every TV show and movie in its library — from The Night Agent (812 million hours) to Ferris Bueller’s Day Off (100,000 hours). While not comparable to the data Nielsen publishes for linear broadcasts — the metric Netflix used is millions of hours watched during a six-month period, as opposed to Nielsen’s average audience number, for example — it’s the first time the streamer has offered such an expansive peek at what does (and doesn’t) get watched on the global platform. “This is the data we use to run the business,” Netflix co-CEO Ted Sarandos told reporters during a conference call.

As part of what it is calling the “Netflix Engagement Report,” the streamer published a list of more than 18,000 movies and shows, covering 99 percent of titles on the service, which were on the streamer between January 1 and June 30 of 2023. The list, which Netflix says will be updated every six months, rounds up viewing hours to the nearest 100,000; series are broken down by season. Because shows and movies have different running times and numbers of episodes, and because many titles in the Netflix acquisition library aren’t available globally, Netflix says the list is not best used to compare how titles do against one another. In addition, some titles have been on the service for years while others were only out a day or a month before the June 30 cut-off point. Case in point: In the example cited at the start of this story, season one of The Night Agent (about nine hours long) was only widely available for about three months during the timeframe of this report and is available to every Netflix subscriber globally; Ferris (running time: 1 hour, 38 minutes) isn’t seen in every country and has been on TV and streaming for decades.

But while today’s report isn’t analogous to, say, Nielsen’s list of the top 100 shows of 2023, it is still a giant leap along what Sarandos called a “continuum of transparency” — and much more data than any other streamer has offered up. In explaining why Netflix had resisted opening up its books for so long, Sarandos was candid. Earlier during the streamer’s existence, “It wasn’t really in our interest to be that transparent because we were building a new business,” he said. “We needed room to learn, and we also didn’t want to provide roadmaps to future competitors. And by not doing public data, there was something the creators liked a lot about it, too, which is it took a lot of pressure off of the overnight ratings model or the weekend box-office model and gave people room to create — not focus so much on the numbers.” Plus, when Netflix was the only real streamer in the game, comparisons didn’t make sense, Sarandos argued: There were no streamers near its size to measure against, and linear networks use a very different model of consumption (scheduled versus on demand).

While this summer’s WGA and SAG strikes resulted in streamers agreeing to share their data with the guilds in order to establish new residual formulas, Sarandos insisted Netflix was already on a path toward sharing more data before the labor action. That said, he admitted that by keeping so much data hidden for so long, what began as a plus for some creators — less pressure to perform — ended up becoming a negative. “The unintended consequence of not having more transparent data about our engagement was it created an atmosphere of mistrust over time with producers and creators and the press about what was happening on Netflix,” Sarandos said. “So we’ve been opening things up [such as] with the top-ten list. And keep in mind we do share this data in even deeper detail with all of our creators.”

But while Sarandos frequently talked about a “continuum” of transparency, he also seemed to suggest the streamer wasn’t anxious to start being even more specific about how its titles perform at a more micro level. For instance, today’s data dump includes viewing around the world and mixes titles which can be seen globally with others that are only in certain markets, both big and small. A more useful tool for creators (and journalists) trying to understand how shows do in their home country, or how NCIS plays in the United States versus, say, Spain, would break out how shows perform by territory or country. But when asked if that sort of data would eventually be shared with the public by Netflix — now that it’s gone well beyond its top-ten lists — the CEO suggested it would not. “We don’t plan on doing it at the country level,” he said. “That’s an enormous amount of competitive intelligence that we’d be putting out there.”

And while U.S. reporters, for example, might want to let readers know which shows are popular just in America, Netflix views things differently. “We run the business as a global company and we have a consolidated global content investment,” Sarandos explained. “So global engagement is really what matters.” He added that this report, as imprecise as it might be, “is a great gauge” of how Netflix titles are resonating (or not) in the broader culture. “Hardly anybody turns off things that they love and hardly anyone watches things that they hate when it’s so easy to switch to something else,” he said. “We think this is the most accurate reflection of that.”

Netflix pointed to some broader trends in this initial engagement report:

➽ Fifty-five percent of the 100 billion–plus viewing hours measured were generated by Netflix originals; the remaining 45 percent came from licensed content. Given how many more hours of licensed content is on the platform — a show like Seinfeld has 180 half-hour episodes, while most Netflix comedies have under 50 episodes (and many far fewer) — the fact that original content makes up the majority of viewing time on the platform is impressive.

➽ Non-English language content accounted for about 30 percent of viewing time on Netflix during the report’s timeframe. Part of that is a result of longer episode counts for successful K-dramas and Spanish-language telenovelas, which often produce dozens of episodes per season.

➽ Demonstrating the long tail effect that’s possible with an on-demand platform, the Netflix original movie All Quiet on the Western Front was able to pull in about 80 million hours of viewing during the first six months of 2023, even though the film debuted in October 2022.