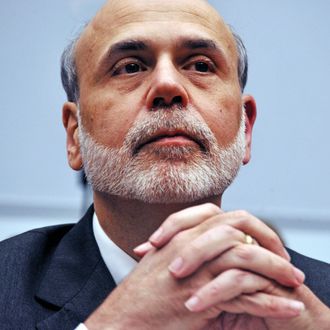

Ben Bernanke, the Federal Reserve chairman whose pronouncements and magical gray beard steer our nation’s monetary policy, took to the stage at an annual conference in Jackson Hole, Wyoming this morning and said … not much.

Many on Wall Street had hoped that Bernanke would announce that the Fed was giving the economy the equivalent of an adrenaline shot by announcing another round of large-scale asset purchases, known as QE3.

But instead, Bernanke played the tease. He spent most of his nineteen-page speech bragging about how well a prior round of asset purchases — QE2 — had worked, acknowledged that America’s BBQ recovery is still problematic, and hinted that the Fed might look to do another round of easing very, very soon, but not right now.

A few key snippets:

“A balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks.” (Translation: That QE stuff we did? It worked. Booyah.)

“In light of the evidence I discussed, it appears reasonable to conclude that nontraditional policy tools have been and can continue to be effective in providing financial accommodation, though we are less certain about the magnitude and persistence of these effects than we are about those of more-traditional policies.” (Translation: We’ll probably do it again … )

“Estimates of the effects of nontraditional policies on economic activity and inflation are uncertain, and the use of nontraditional policies involves costs beyond those generally associated with more-standard policies. Consequently, the bar for the use of nontraditional policies is higher than for traditional policies.” (Translation: But maybe not for a while, because we’re skeeeeered.)

The Dow initially fell on Bernanke’s lack of a QE3 announcement, then gained 100 points when Wall Street read to the end of the speech and saw how strongly Bernanke implied future action.

Less impressed by Bernanke’s speech were those who believe the Fed should act more forcefully to spur the economy and curb massive unemployment, using all the tools it has at its disposal. To these folks, Bernanke’s cautious approach feels like that of a doctor who sees a recovering patient, tells the patient his medication seems to be working well, hints that another round of the same drugs might help him feel even better, but then refuses to refill the patient’s prescription right away.

University of Michigan economist Justin Wolfers tweeted, “Bernanke claims credit for 2 million jobs gained, relative to no QE. But how many million jobs has he lost, relative to optimal policy?”

The Economist’s economics correspondent, Ryan Avent, tweeted, “This Bernanke speech makes me want to cry. Zero intellectual progress. Zero rethinking of incredibly narrow policy frame w/i which Fed is operating. Complete buck passing.”

But others were more optimistic, noting that roughly half of Bernanke’s speech was a defense of easing, and that the entire speech sounded like a set-up for another round of easing in the near future.

Wall Street Journal Fed scribe Jon Hilsenrath wrote that Bernanke’s slow tease “left little doubt that he is looking toward doing more to give the economy a lift at the Fed’s next policy meeting in September.” Bill Gross, PIMCO’s bond fund buccaneer, tweeted, “Bernanke to go out with his guns blazing. #QE3 a near certainty. It will be open-ended but increasingly impotent.”

If Bernanke wasn’t leaning toward QE3 before, hearing Bill Gross call him impotent may just push him over the edge.