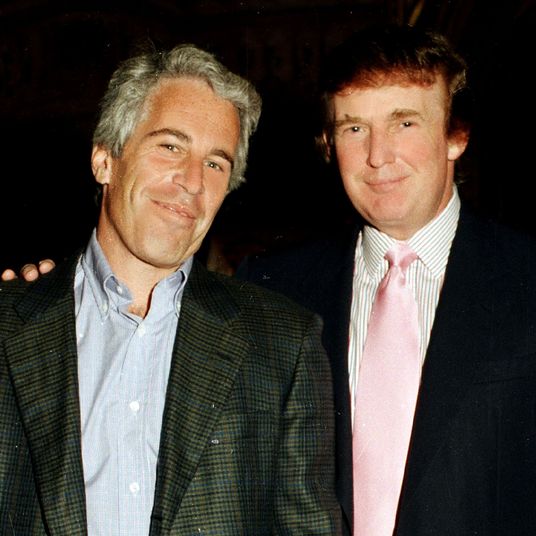

God help us to survive this unholy love. Photo Illustration: Everett Bogue; Photos: Getty Images, Reuters

For sub-prime sufferers who blame Alan Greenspan for setting off the collapse with his low-interest-rate policy, today’s announcement that the former Federal Reserve chairman has joined up with John Paulson, the Queens native and hedge-fund manager who famously made billions of dollars betting against the mortgage market, must especially sting. Paulson & Company, which has assets of $28 billion, have hired Greenspan to be their own personal Nostradamus — they’re the only hedge fund he will advise on the direction of the economy and for whom he will assess, according to the Financial Times, “the potential for and severity of a US recession,” so that next time there’s a giant bust (credit cards! Auto loans!), they can roll around in piles of filthy lucre while the rest of us rubes wail and tear our garments in the streets. Although not if we’re canny. According to the Journal, Paulson, who recently gave a presentation titled “The Worst Is Yet to Come,” has been known to tell investors “it’s still not too late” to bet on economic troubles.

Trader Made Billions On Subprime [WSJ]

Greenspan Joins NY Hedge Fund [FT]