The folks at OpenSecrets.org have unearthed Paul Ryan’s 2008 financial disclosure forms.

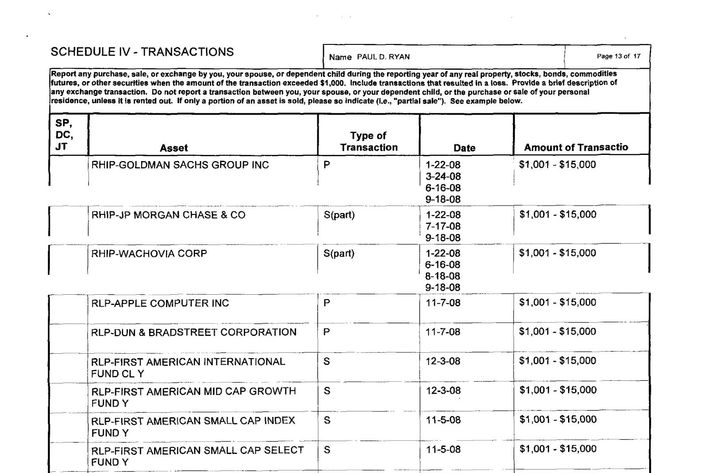

The lines that are getting people’s attention are a couple of bank stocks Ryan traded on September 18, 2008, the day a group of Congressional leaders got their now-famous “pass TARP or we won’t have an economy on Monday” talk from then–Treasury Secretary Hank Paulson and Fed Chairman Ben Bernanke. The day of the meeting, his disclosure forms show, Ryan sold shares of JPMorgan Chase, Wachovia, and Citigroup, while buying shares of the comparatively healthier Goldman Sachs.

It would be easy to take a casual look at the date of Ryan’s trades and surmise that he went home from the Paulson-Bernanke briefing, called his broker, and made a profit on non-public information. The Richmonder, a liberal-leaning blog that was among the first to write about Ryan’s trades, called them “more than a little shady.” Matthew Yglesias at Slate called it “about as clear an example of a public official trying to use his office to obtain personal benefits as you’re likely to find.”

The Ryan-as-Rajaratnam narrative is tempting for the vice-presidential candidate’s critics. But it’s almost certainly wrong.

First, consider that the Paulson-Bernanke briefing took place on the night of September 18 — beginning around 7 p.m. Ryan’s trades occurred before markets closed on the 18.

J. Bradford DeLong, a professor of economics at the University of California-Berkeley pointed out that the manner in which Ryan moved in and out of stocks like Citigroup frequently that year — all in trades of less than $15,000 — had the amateurish feel of a twitchy investor who chooses stocks using relatively unsophisticated assessments of their relative values.

“It doesn’t look like someone who is making a hell of a lot of money from trading on inside information,” DeLong said. “It looks like someone who doesn’t understand the structure he’s in.”

A spokesman for Ryan was not immediately available to comment on the nature and timing of the trades.

Keep in mind, also, that the practice of Congressional insider-trading was totally legal until earlier this year, when Congress got embarrassed by 60 Minutes and decided to outlaw it via the Stop Trading On Congressional Knowledge Act.

That means that even if Paul Ryan did, at some point, use information he had gleaned from briefings to trade stocks, he would have been just one of many, many elected officials — Spencer Bachus and Nancy Pelosi are among the others whose trading activities were questioned — to have participated in the then-legal practice.

Granted, Ryan’s trades are bad optics. Even when it isn’t illegal, or even particularly lucrative, a vice-presidential candidate hearing a closed-door jeremiad about the health of the financial sector the same day he sells most of his bank stocks looks bad.

But, since the facts don’t line up, let’s not confuse a couple of trades Paul Ryan made on September 18, 2008 with a real scandal. There are many less-than-flattering things to call Paul Ryan — an enemy of the middle class, an Ayn Rand disciple, “the worst” — but an insider trader isn’t one of them.