Quick: name one ketchup company. Then name another.

The hesitation you likely just had before the second name is, in a nutshell, why Warren Buffett and 3G Partners, a Brazilian private equity firm, just spent $28 billion to acquire the H.J. Heinz Co. Heinz is so dominant among ketchup-makers — it has 60 percent of the U.S. ketchup market, and nearly an 80 percent market share in the U.K.— that it seems foolish to bet against.

In many ways, buying Heinz is stereotypically Buffett. It’s a dividend-paying, slow-growth company that makes actual, consumable products, unlike a social network or a complex financial institution. And it’s classically American, which goes well with the shtick he’s developed over the years by buying old-fashioned businesses like railroads and newspapers and doing folksy things in public.

Unlike on most of Berkshire Hathaway’s deals, Buffett used a bidding partner to make a play for Heinz. 3G Partners, which also owns Burger King (and whose principal investor, Brazilian billionaire Jorge Paulo Lemann, is a longtime friend of Buffett’s), is putting up half the money for the acquisition. That may be a financial and strategic decision, but I suspect it has a geographical element as well. 3G, which has shown interest in American businesses before, also has a ton of experience in expanding them into new markets.

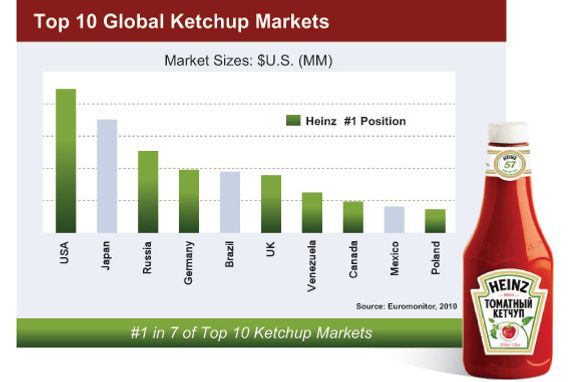

Heinz is already on its way to becoming a global behemoth. As the below chart shows (I think — it seems to lack y-axis labeling), it’s got a strong foothold in lots of other countries, where owing to the Americanization of Everything, ketchup is becoming a desired condiment.

According to Heinz’s most recent annual report, emerging markets make up an entire quarter of the company’s entire sales. Ketchup sales are especially strong in China, Brazil, and Venezuela, according to the company. China and Brazil, with their huge populations, are especially lucrative markets.

But the money isn’t all from ketchup. Heinz already owns Quero, a Brazilian ketchup- and sauce-maker, and Foodstar, a Chinese soy-sauce-maker. It also owns a lucrative infant food/nutrition business, which brought in $1.2 billion in sales in fiscal year 2012. And it has a bunch of other brands under its umbrella, including Ore-Ida potatoes and frozen Weight Watchers SmartOnes meals.

Heinz’s presence abroad — and its expansion into lots of non-ketchup products — is a promising sign. It means that Heinz, with new owners committed to keeping its market share high in the U.S. while pumping money and effort into foreign growth, could become as dominant in other countries as it is here, without having to make ketchup the world’s condiment of choice. Which wouldn’t be a bad outcome for a formerly bankrupt horseradish company.