Last year, famed Republican economist Art Laffer co-authored a hagiographic tribute to President Trump and his agenda. Trump habitually bestows his most slavish supporters with pardons or — in the event they have not been convicted of any federal crimes — awards. Laffer accordingly will receive the Presidential Medal of Freedom today.

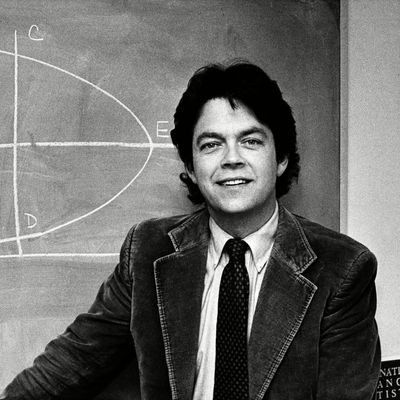

But Laffer’s place of honor within his party was settled long ago. In 1974, he and Jude Wanniski, then a Wall Street Journal editorial writer, began proselytizing among Republicans for a new theory the two had worked out together. The breakthrough moment, at least according to legend, came when Laffer scrawled a curve on a cocktail napkin for Dick Cheney. The Laffer curve, as it came to be known, showed that the tax rate at the bottom, zero percent, and the top, 100 percent, both yielded identical revenue of zero. The curve connecting these numbers indicated that a lower tax rate could produce higher revenue.

Laffer’s more gentle critics, while noting that his curve fails to describe existing reality, have conceded that his curve is correct in the abstract. “There’s no question there’s a Laffer curve,” says Republican economist Douglas Holtz-Eakin. “There’s always a question as to where you are on it.”

Even this limited defense of Laffer is provably untrue. Of course a zero percent tax rate yields zero revenue, but a 100 percent tax rate definitely does not yield zero revenue. Many governments have imposed 100 percent tax rates and have still managed to collect a great deal of revenue. (Ask yourself how the Soviet Union managed to control a vast empire for the better part of a century.) The conservative economist Casey Mulligan has found several examples of democratic states where some people, especially pensioners, faced marginal tax rates at or above 100 percent, and their labor did not disappear. I would personally prefer not to pay a 100 percent income tax, but under such circumstances, I would not cease working. Many other people would make the same choice.

This is not merely a technical objection. It exposes a conceptual flaw underlying Laffer’s entire premise. People are not, in fact, utility-maximizing robots. They choose to work for reasons other than maximizing their incomes on the margin: habit, pride of craft, and so on. Most taxes probably produce the highest revenue at rates below 100 percent, but the curve does not resemble Laffer’s, and it does not hit zero.

In the real world, Laffer’s contributions have built a streak of unbroken wrongness over a time and scale few policy entrepreneurs in history can match. Laffer predicted Ronald Reagan’s tax cuts would pay for themselves. When they instead produced historic deficits, Laffer continued to claim he was right. He predicted Bill Clinton’s attempt to reduce the deficit by raising taxes on the rich would backfire (“I think the plan will fail. It entails price controls, which have never worked. It calls for tax increases, and that’s exactly the wrong way to go. It makes no sense to raise taxes on people who work and pay more to those who don’t work. This is the Reagan revolution in reverse”). Instead, revenue growth exceeded projections.

He likewise predicted President Obama’s plan would “destroy the economy” (it did not) and that President Trump’s tax cut would “pay for itself many times over” (it did not pay for itself at all), among many other failed predictions. Not content to botch his analysis of the federal budget, he has parachuted into several state governments and prodded Republicans into adopting his utterly false worldview. In Kansas and Louisiana, Republican governors listened to Laffer and produced fiscal catastrophe so comprehensive and undeniable Republicans in their state revolted.

Economists do not take Laffer’s claims seriously. This has not reduced his influence whatsoever. Laffer has elevated his curve to metaphysical status within the party, which treats the skepticism of economists as more evidence of their own correctness. “Economists still ridicule the Laffer Curve,” boasted Wall Street Journal editorial page editor Robert Bartley, “but policymakers pay it careful heed.”

A dozen years ago, I wrote a book attempting to explain the mystery of how Laffer’s kook theory took hold of a major political party and could not be dislodged even after multiple high-profile failures.

The failures have not stopped since then, but the intervening era has made the mystery a whole lot less mysterious. The list of policies in which Republicans cling to a position dismissed by academics and experts has continued to grow.

The rise of Donald Trump has shown that even those of us who had the harshest view of the Republican Party’s capacity to weigh evidence had nonetheless given it far too much credit. Of course a party that has fallen in line behind Donald Trump would elevate a crank like Art Laffer to the status of economic savant. How could it not?