A few months ago, I wrote about a very strange PowerPoint presentation from SoftBank CEO Masayoshi Son, explaining how the company intended to turn around WeWork, in which it holds a large equity stake that grows periodically as SoftBank makes equity investments in WeWork that nobody else is willing to make.

You may remember this presentation for its amusingly light slides, using big arrows and few words to express SoftBank’s intention that WeWork should increase revenues and reduce expenses and therefore make profits. But I focused on one lesser-noticed slide, in which Son argued that SoftBank owned investments in other companies with a value of $206 billion — a plausible estimate based mostly on those companies’ own stock prices, not relying on WeWork-style pie-in-the-sky ideas about the potential to change the nature of human consciousness through office space — while SoftBank’s own equity market capitalization was just $82 billion.

I wrote at the time:

Son does not explore an obvious follow-up question: If this chart you have shown us is right, then why does the stock market treat your company as being worth $120 billion less than the sum of its parts? One obvious answer is that the stock market expects him to take the profits from successful investments like [Chinese internet giant] Alibaba and pour them into shitty investments like WeWork. Classically, if a conglomerate’s market capitalization is less than the total value of its businesses, the right thing to do is break it up. What this chart says is, if you bought SoftBank, fired Son, and sold the company off for parts, you’d make a profit of $120 billion.

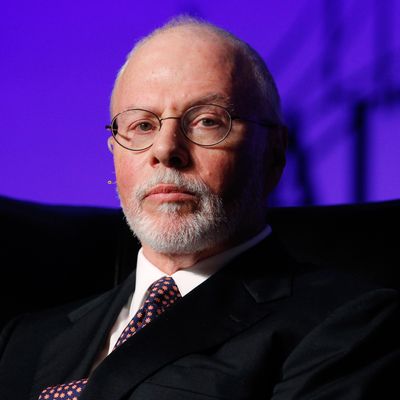

It seems this idea has also occurred to Paul Singer, the billionaire hedge fund manager who runs Elliott Management Corp. Singer is not necessarily trying to get Son fired, yet. But the Wall Street Journal reports that Elliott has taken a more than $2.5 billion stake in SoftBank — about 3 percent of the company’s shares — and is seeking to influence the company’s management.

Specifically, the Journal says Elliott wants SoftBank to improve corporate governance — presumably, that means making investment decisions on a more concrete basis than whether Son thinks a founder seems cool at a first meeting — and to buy back between $10 billion and $20 billion in SoftBank shares, effectively returning more of SoftBank’s profits to investors and plowing less of them into hot, new companies.

Share buybacks have gotten a bad name in political discussions about investing. But whether buybacks are bad depends entirely on what a firm will do with money if it doesn’t get returned to shareholders. If SoftBank had a long list of value-creating investment ideas that would benefit both shareholders and society in the long run, more buybacks would be a terrible idea. But if SoftBank’s plan is to find someone else like Adam Neumann and hand him several billion more dollars to light on fire, it’s understandable that SoftBank shareholders would argue that the money should instead go to buybacks, so they can come up with their own, less-stupid ideas about how to invest the money.

The thing about SoftBank is that so much of its value right now is tied up in one great decision that was made in the past: making an early investment in Alibaba that paid off handsomely. SoftBank owns interests in a number of other businesses with bona fide value, such as wireless carriers in the U.S. and Japan. Son is right that all those investments have value that’s not getting reflected in the SoftBank’s stock price. And Singer has a sensible idea about how to get the markets to reflect it: put Son in a box and stop him from wasting the profits those investments are expected to throw off.