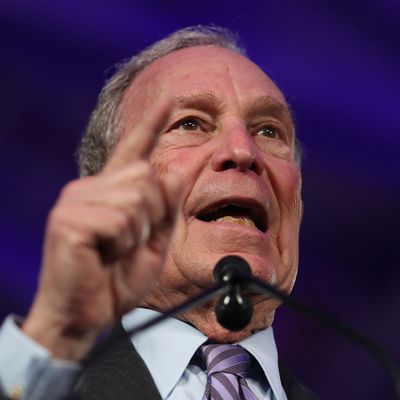

As the financial crisis first began to strangle American homeowners, Michael Bloomberg, then the mayor of New York, identified a scapegoat. Bloomberg didn’t blame the banks for handing out subprime mortgages; he blamed the consumers who’d applied for them.

On an August 2007 broadcast of “The John Gambling Show” on WABC, Bloomberg first aired a pronouncement that he would later repeat during the recession and after it. “What happened here is a bunch of people who didn’t really have the wherewithal to get mortgages, got mortgages,” Bloomberg told Gambling. “Now, if they didn’t have access to those mortgages, the elected officials would scream, you’re discriminating against them. Some of them lied about their incomes, some by a lot. Now they say, ‘Oh, well, the salesman convinced them to do it.’ But we live in a world where when you put your signature down, you’re supposed to know what you’re signing, and you have to take responsibility. Because every time there’s a victim, we’ve got to find somebody that’s responsible for it.”

Months later, Bloomberg would directly link the financial crisis to the end of redlining, as the Associated Press first reported in February. “Redlining, if you remember, was the term where banks took whole neighborhoods and said, ‘People in these neighborhoods are poor, they’re not going to be able to pay off their mortgages, tell your salesmen don’t go into those areas,’” Bloomberg told an audience at Georgetown University in 2008. When Congress interfered to end the practice, which kept neighborhoods segregated and depressed rates of home ownership among black households, Bloomberg claimed that “banks started making more and more loans where the credit of the person buying the house wasn’t as good as you would like.”

In 2011, with Occupy Wall Street in full force, Bloomberg again blamed consumers, and Congress, for the recession. “I hear your complaints. Some of them are totally unfounded. It was not the banks that created the mortgage crisis. It was plain and simple Congress, who forced everybody to go and to give mortgages to people who were on the cusp,” he said at a meeting of the Association for a Better New York.

Reached for comment, Stu Loeser, a spokesperson for Bloomberg, said that the former mayor “was among the first to detail the many causes of the financial crisis, and as he said at the time in various longer remarks, automated trading, ineffective regulation, actions by big banks and changes in the global economy were part of the equation.”

“But in this and other comments,” Loeser added, “he’s primarily blaming unscrupulous lenders who over the years switched from not lending at all in certain places — redlining — to targeting people with bad financial instruments. As mayor, Mike was actually one of the first officials anywhere to take on predatory lending, and after leaving office his foundation helped other cities do the same.”

Nevertheless, Bloomberg’s remarks reinforce a growing image problem for the former mayor. The Michael Bloomberg who is running for president looks like a recent construction. Now a supporter of a $15 minimum wage, Bloomberg criticized the very concept of a minimum wage as recently as 2018. But the discrepancy between the new Bloomberg and the previous version the people of New York City know best is widest, perhaps, on the issue of race. The Bloomberg who published a lengthy criminal-justice reform plan on his campaign website bears little resemblance, at least superficially, to the Bloomberg who increased stop and frisk arrests with gusto. In this same vein, Bloomberg’s old comments about redlining undermine the slickly progressive product featured in his massive nationwide marketing campaign.

Bloomberg’s repetitive comments pinning the blame for the recession on the shoulders of individual homeowners only reinforces the perception that he’s disdainful of lower-income people of color. Researchers have concluded that the financial crisis inflicted outsized harms on black households, with women of color the most frequent targets of subprime lending practices. By the end of the recession, Jamelle Bouie wrote in 2014, “Median household net worth for blacks had fallen to $5,677 — a generation’s worth of hard work and progress wiped out.” Among white households, meanwhile, net worth declined to $113,149. As of 2019, rates of homeownership among black households still haven’t recovered to prerecession levels. That’s a problem President Bloomberg could help remedy — but only if he’s changed his views, again.