Donald Trump believes that tailoring U.S. tax policy to the preferences of the American people — rather than to those of multinational corporations and their lobbyists — constitutes a “globalist betrayal” of the United States and an act of “economic surrender” to “special interests” and their lobbyists.

Or so the former president’s Orwellian denunciation of Joe Biden’s infrastructure plan would suggest.

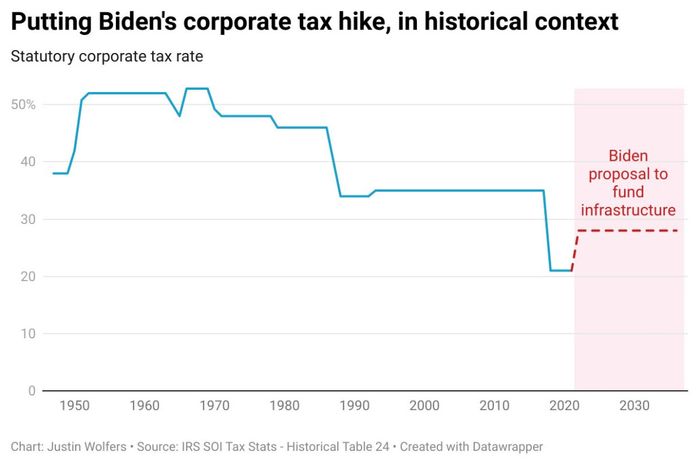

On Wednesday, the White House unveiled its plan to rebuild the U.S. economy on corporate America’s dime. Specifically, the administration outlined $2 trillion of investments in infrastructure, green technology, and eldercare, along with an array of taxes on wealthy Americans and corporations — among them, an increase in the corporate tax rate from 21 to 28 percent and an increase in the minimum rate that U.S. corporations must pay on profits earned abroad from 10.5 percent to 21 percent. In the plan, Biden also vows to strong-arm weaker nations into raising their own corporate tax rates to a new global minimum level. In the view of Gabriel Zucman, a UC Berkeley economist and leading expert on tax evasion, if Biden’s plan is enacted, “the development model of tax havens collapses.”

At first brush, this might look like a patriotic, populist policy. After all, the proposal effectively takes money away from corporate shareholders (a disproportionately elite, cosmopolitan, and coastal-dwelling population) and U.S. firms that make a lot of money overseas and spends it on creating jobs and improving public works throughout the American heartland. What’s more, while the package’s tax provisions are opposed by the Chamber of Commerce, they enjoy majority support among the American public. In other words: Biden’s plan seems like a policy that prioritizes the interests of the median American over those of global capital. One might even say that it puts “America first.”

Alas, Donald Trump regrets to inform us, this couldn’t be further from the truth. As the billionaire wrote in a statement Wednesday:

Biden’s ludicrous multi-trillion dollar tax hike is a strategy for total economic surrender … Under Biden’s plan, if you create jobs in America, and hire American workers, you will pay MORE in taxes — but if you close down your factories in Ohio and Michigan, fire U.S. workers, and move all your production to Beijing and Shanghai, you will pay LESS. It is the exact OPPOSITE of putting America First — it is putting America LAST! …

This tax hike is a classic globalist betrayal by Joe Biden and his friends: the lobbyists will win, the special interests will win, China will win, the Washington politicians and government bureaucrats will win — but hardworking American families will lose.

I can’t speak with expert authority on how the tax provisions in Biden’s proposal would impact corporate offshoring. But Trump provides exactly zero evidence for his claims. And there are many reasons not to take his word on this subject (or any other).

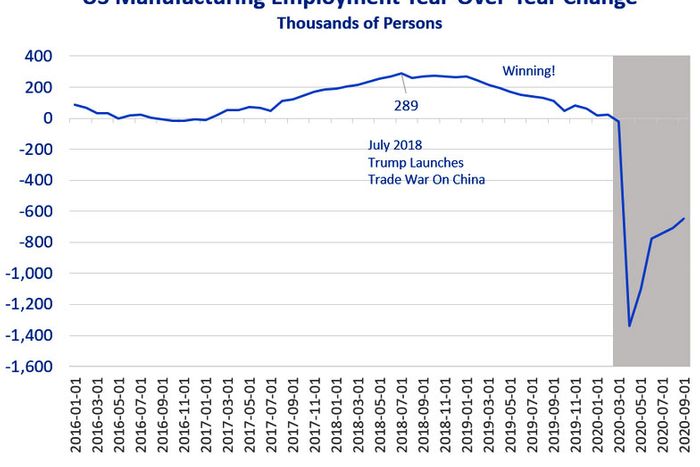

For one thing, Biden is merely proposing to bring America’s corporate tax rate halfway back to where it was in 2017. It is hard to believe that a 7-point corporate-rate hike would have a massive impact on the prevalence of offshoring when Trump’s 14-point cut to that rate did not: Between the signing of the Trump tax cuts and the onset of the COVID pandemic, manufacturing employment in the United States declined.

One could argue that the drop would have been even sharper absent the president’s policy. But if so, that would mean that changes in the corporate tax rate are less consequential for U.S. manufacturing employment than other factors.

Meanwhile, as already mentioned, the Biden plan includes a variety of taxes specifically targeting U.S. firms that move jobs and investments to low-tax nations overseas. For their part, such tax havens seem to have a different assessment of Biden’s proposal than Donald Trump does. As The Irish Times reports:

The Republic’s 12.5 per cent corporate tax rate is facing a new threat, with the United States signalling its support today for a global minimum corporate tax rate of 21 per cent on its companies.

Proposals emerging from the White House on Wednesday say the US administration intends to push for this new global minimum rate to be passed by Congress — essentially meaning US companies here would have to pay a top-up tax in the US after paying at 12.5 per cent here …

It remains to be seen what is passed by the US Congress, but the implication is that if the bulk of this is passed, Ireland’s 12.5 per cent rate may no longer be a significant attraction for US companies looking for where to invest.

Given the Biden’s plan’s hike in the global minimum rate — and its large investments in domestic manufacturing and supply chains — it is difficult to believe that the proposal would result in a net-reduction in U.S. jobs. Trump’s entire argument boils down to the observation that raising the corporate rate will make it a bit less profitable to do business in the U.S. But the same would be true of any policy that increased American wages without simultaneously increasing wages for workers in other nations. Presumably, Trump does not believe that all policies that raise the pay of American workers, by making the U.S. marginally less appealing to global capital, constitute a “globalist betrayal” (even if the mogul did argue that American wages were “too high” at a 2015 GOP primary debate).

Even if the substance of Trump’s argument were more credible though, it’s framing would remain absurd. The mogul is effectively arguing that the U.S. nation-state is too weak to dictate terms to global capital and must therefore subordinate its citizens’ preferences on tax policy to those of multinational corporations. In other words, he’s making a case for acquiescing to globalization: The U.S. cannot achieve economic prosperity through muscular assertions of national sovereignty; it can only do so by handing its taxing powers over to global corporations in exchange for unenforceable promises of more productive investment.

The Biden position, by contrast, is that the U.S. is actually such a great nation, we can attract investment without keeping our corporate tax rate at a historic low — and that we are such a strong nation, we can diplomatically coerce other countries into following our lead on tax policy.

Trump characterizes his position as a nationalist, populist rejection of globalism and Biden’s as an “economic surrender.”

The absurdity of Trump’s argument should be apparent even to conservatives; at least, if they apply its logic to other contexts. For example, Major League Baseball is currently threatening to move this summer’s All Star Game out of Atlanta in protest of Georgia’s recently passed voting restrictions. This would impose a (small) toll on the Peach State’s tourism economy. By Trump’s reasoning, the Georgia State legislature’s refusal to take the MLB’s orders on voting rights constitutes an act of “surrender,” as it could have the consequence of forfeiting economic opportunity to some other (potentially more Democratic) state. In this case, Republicans would surely insist that defending state sovereignty against corporate ransom is the opposite of surrender. And they more or less did say it when various corporate interests boycotted North Carolina following its passage of an anti-transgender “bathroom bill.”

To be sure, “Donald Trump released a stupid statement suffused with ironic projection” is not a notable development in itself. But Trump’s self-contradictions reflect those of his party. The contemporary GOP demonizes large corporations as “woke” betrayers of the American people while nevertheless fighting doggedly to prioritize their material interests above the well-being of their own constituents. Republicanism remains the populism of fools.