Congressional Republicans are on the brink of throwing the U.S. economy into a brutal recession, triggering a global financial panic, and vandalizing the foundations of American geopolitical power — all for the sake of gaining fodder for disingenuous midterm attack ads.

Congressional Democrats, meanwhile, are on the brink of doing the very same things, just to preempt those 30-second spots (and thus force Republicans to hit them with slightly different disingenuous attack ads).

This may sound like the synopsis of some tedious, Aaron Sorkin–helmed political satire. But it’s a straightforward description of the debt-ceiling standoff in Washington, D.C., today.

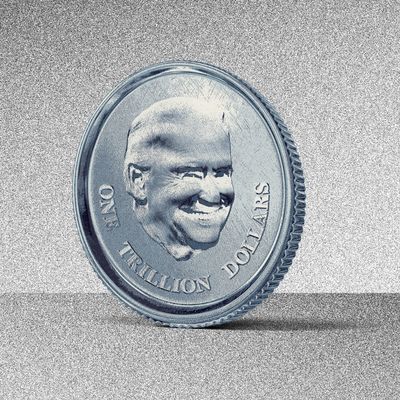

And according to some economic experts, this extraordinarily stupid policy crisis demands an extraordinarily stupid policy solution: To keep America’s finances in order, Joe Biden might need to order the creation of a $1 trillion commemorative coin.

Here’s a guide to why Congress is locked in a stalemate over raising the debt ceiling, how the president could potentially raise it on his own, and why “minting the coin” just might be the only way to prevent the U.S. government from defaulting on its debt this fall.

What the debt ceiling is and why raising it is cool and good

In most OECD countries, the fiscal-policy process goes roughly like this: The national legislature passes laws that authorize spending and taxation, and then the government borrows money to cover the gap between the two.

The U.S. follows a similar procedure, except our process includes a second step. Long after Congress has already approved deficit-increasing budgets, it must take a subsequent vote on whether it will allow the Treasury to borrow the funds necessary for meeting its previous demands. This is because America has a statutory limit on how much debt its government is allowed to hold. Congress must therefore raise this “debt ceiling” whenever the budgets that it already authorized generate debt in excess of the previous statutory limit.

Thus, raising the debt ceiling does not increase the amount of money that the U.S. government owes to its bondholders (who are overwhelmingly U.S. citizens). It just prevents the government from having to either default on its debt, or else, on its statutory obligations to U.S. service members, Social Security recipients, Medicaid enrollees, and/or the myriad other beneficiaries of federal spending. Depending on how high the new debt limit is set, raising the ceiling can theoretically facilitate future deficit spending. Generally, though, Congress does not raise the debt limit high enough to cover even mandatory spending for very long, and must therefore vote to raise the ceiling again and again, every few years.

It is worth noting, briefly, that there is little evidence that America’s national debt is dangerously high. As a share of gross domestic product (GDP), Japan’s debt level is more than twice as high as America’s — and the Japanese nevertheless enjoy some of the world’s highest living standards and an unemployment rate of below 3 percent.

Which is to say, just because a nation-state’s debt adds up to a very large number does not mean that its debt is unsustainable or economically detrimental. Generally speaking, a country that has been racking up ruinous debts will see its borrowing costs increase as investors lose faith in its capacity to meet its obligations. The U.S., by contrast, saw its borrowing costs fall over the past three decades, even as it added trillions of dollars to its debt. Global investors — those with real “skin in the game” — believe that U.S. Treasury debt is the safest asset in the world. In their estimation, the U.S. economy’s growth potential renders Uncle Sam more than capable of keeping up with his interest payments (and making those payments in a currency that retains high global value).

So, America is not embroiled in a debt crisis that demands immediate austerity, let alone more radical measures. And even if it were, raising the debt ceiling would be indispensable to restoring our nation’s fiscal health. In reality, just about the only thing that could turn America’s debt into a crisis would be if our government decided to stop making its interest payments for no good reason. If Congress does not raise the debt ceiling by October 18 — the Treasury Department’s latest estimate for when America’s debt level could exceed the current limit — the U.S. may be forced to do just that.

What would happen if the debt ceiling isn’t raised?

This question is impossible to answer with certainty, since there is no precedent or historical analog for the world’s greatest financial power ceasing to pay its debts because its political class was just sort of dicking around.

This said, there’s reason to think that a debt-ceiling breach would be extremely bad. U.S. Treasury bonds are the foundation of the entire global financial system. Financial actors the world over have structured their assets and liabilities around the presumption that such bonds are essentially riskless. If the U.S. defaulted on its interest payments, just about everyone’s investment strategy would be upended. Global markets would be destabilized. America’s borrowing costs would soar, as investors demanded compensation for the risk of lending money to the U.S. That increase in interest rates would spread throughout the economy, driving up rates for consumers, businesses, and homeowners. This would lead to a pullback in consumer spending and corporate investment. A recession would ensue. According to one estimate from Moody’s Analytics, a prolonged stalemate over the debt ceiling could kill 6 million U.S. jobs, nearly double the nation’s unemployment rate, and erase $15 trillion from American household wealth. Such a scenario would also jeopardize the dollar’s status as the world’s reserve currency — an exorbitant privilege that serves as one pillar of the nation’s geopolitical power.

If Congress fails to lift the debt ceiling, it is unlikely that the U.S. government would immediately miss its interest payments. When the Obama administration was forced to plan for that scenario, it intended to prioritize payments to bondholders, Social Security recipients, and military personnel, while abruptly halting funding to just about everything else. If Congress did not restore the government’s borrowing powers soon after the ceiling was breached, however, Uncle Sam would run out of funding for even these select purposes in short order.

Why Congress still hasn’t raised the debt ceiling, anyway

Today’s national debt adds up to a very large number of dollars. And many voters do not realize that the debts a monetarily sovereign nation-state owes to its own bond-holding citizens and the debts they personally owe to credit card companies are categorically different things. That misunderstanding makes it easy to get voters to see the national debt as a major problem, if not the root cause of their more concrete complaints with the economy.

Voting to “raise the debt limit,” meanwhile, sounds a lot like directly voting to raise the debt. And that’s a pretty unpopular proposition. It’s one thing to vote for tax cuts or spending increases that add to the national debt. But voting just to increase the debt? With no immediate offsetting benefit? Well, that’s the kind of thing that sounds really bad in a 30-second negative ad.

For these reasons, Congress members in both parties have long used debt-ceiling votes to score political points. Voting against raising the debt limit was a way to register disapproval of the opposing party’s spendthrift policies and/or protect yourself from attacks on your own fiscal rectitude. But until a decade ago, all involved understood that this cynical gamesmanship shouldn’t be allowed to threaten the full faith and credit of the United States. Party leaders made sure there were always enough “yes” votes for a debt-ceiling hike to pass.

The Tea Party Congress changed that. In 2011, House Republicans threatened to deliberately sabotage the U.S. economy if President Barack Obama didn’t agree to cut domestic spending. Two days before the Treasury Department’s deadline for hiking the debt limit, the White House paid the GOP’s ransom. Once a mere prop for political theatrics, the debt ceiling became a source of routine crisis.

After taking the House in 2018, the Democratic Party had a chance to give the GOP a taste of its own medicine: It was now in position to take the debt ceiling hostage, secure in the knowledge that voters would likely blame the opposing party’s president for any economic catastrophe. But Nancy Pelosi’s caucus didn’t have the stomach for such nihilistic brinkmanship, nor much hope of tricking Republicans into thinking that it did. The Democrats agreed to help Trump raise the debt ceiling, despite their objections to his deficit-increasing tax cuts. For some stupid reason, however, they consented to a debt-ceiling increase so small, it was bound to expire during the first year of the next administration.

In any case, after doing Trump a solid, congressional Democrats feel that they are entitled to the GOP’s aid in raising the debt ceiling today. Republicans have tried to alert their Democratic friends to the fact that they have no sense of honor or fairness, and are really, truly willing to sabotage the economy for political gain. The GOP isn’t just refusing to give Democrats bipartisan cover for raising the debt limit. Mitch McConnell & Co. are using the filibuster to prevent Democrats from passing a debt-ceiling hike on their own through regular order. Crucially, McConnell’s official position is that the debt ceiling must be raised promptly. He has actually scolded Democrats for taking their sweet time in doing so, telling reporters, “This Democratic government must not manufacture an avoidable crisis.”

The GOP isn’t saying that the debt limit shouldn’t be increased, or even that Democrats should make specific spending cuts to secure bipartisan cooperation in raising the debt limit. Rather, the GOP’s view is that Democrats should raise the debt ceiling by themselves — so that it can attack them for doing so in misleading campaign ads next fall.

Understandably, Democrats are not eager to walk into this trap. Less understandably, they appear more concerned with preventing themselves from being “owned” than the U.S. economy from being sabotaged.

How congressional Democrats could raise the debt ceiling on their own

Democrats can’t pass an ordinary bill raising the debt ceiling without either (1) Senate Republicans’ cooperation or (2) abolishing the legislative filibuster. The GOP refuses to provide the former, and Joe Manchin loves the latter more than life.

But that still leaves Democrats with one viable option. A special type of legislation known as a “budget reconciliation bill” cannot be filibustered in the Senate. And budget reconciliation can be invoked to raise the debt limit once every fiscal year. Democrats could therefore use that process to pass a debt-ceiling hike on their own. This is, in fact, what McConnell has told the party to do.

The downside of this option is that budget reconciliation is an elaborate process chock-full of so many arbitrary rules that it would take weeks just to pass a clean debt-ceiling-hike bill through a reconciliation bill. Doing so would also likely require Senate Democrats to cancel their October recess. On Wednesday, the Senate’s second-highest-ranking Democrat, Dick Durbin, told Politico, “Using reconciliation is a nonstarter. We have gone through it twice, I’ve listened, and it takes him about 15 minutes for Chuck Schumer to explain how that works, what it involves. Three or four weeks of activity in the House and Senate.”

This isn’t a great excuse for not raising the debt limit through reconciliation. Yes, the process is arduous. But it would allow Democrats to effectively abolish the debt ceiling, once and for all, by raising the debt limit to “googolplex dollars,” or else simply decreeing that from this point forward, the debt ceiling will be set at a level equivalent to the total debt that the U.S. government holds.

This said, because reconciliation is arduous, it becomes a less viable option with each passing day. With congressional Democrats still dragging their feet, it’s possible that the fate of the U.S. economy rests on Joe Biden’s willingness to “mint the coin.”

How the president could prevent a debt default by minting a $1 trillion commemorative coin

Back in 1995, America’s coin collectors successfully lobbied Congress for legislation that would empower the Treasury Department to mint collectible platinum coins in a greater variety of sizes. The idea was to facilitate the creation of smaller, cheaper coins to help less affluent coin collectors get in on the sweet platinum action.

In writing this legislation, however, Congress accidentally — and yet quite explicitly! — gave the Treasury secretary extraordinary money-creation powers. Here’s the relevant provision:

The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

In 2011, the blogger Carlos Mucha, writing under his commenter name “Beowulf,” noted that this law seemed to provide a debt-ceiling work-around: If the Treasury secretary has the power to mint platinum coins of any denomination, then he or she could (1) mint a $1 trillion platinum coin and then (2) take it to the Federal Reserve and use it to repurchase $1 trillion in Fed-held U.S. Treasury debt. Just like that, the U.S. debt level would be brought well below the statutory ceiling, and the government could carry on paying interest on its debt while meeting all its statutory spending obligations.

Notably, such an action would not be inflationary “money printing.” The supply of money circulating in the real economy would not change. One branch of the government would simply deposit a coin in the account of another branch of government, thereby erasing $1 trillion from the national debt. Nothing would change except accounting figures that Congress has fetishized. This is part of what makes the “mint the coin” option so appealing to critics of Beltway deficit politics in general, and proponents of Modern Monetary Theory in particular: It helps expose the absurdity of fixating on national-debt totals that are already influenced by factors nearly as arbitrary as the platinum-coin gambit, while spotlighting our government’s absolute sovereignty over money creation.

Anyhow, the debt-ceiling showdowns of 2011 and 2013 both got so dire, national business and political reporters started taking the coin option seriously. And the Obama administration itself appears to have given it some consideration, despite ultimately rejecting it.

Today, Democratic House members Jerry Nadler and Rashida Tlaib are imploring Treasury Secretary Janet Yellen to mint the coin, while House Budget Committee chair John Yarmuth has argued that it should be considered if legislation isn’t passed.

On the face of it, the platinum-coin option appears perfectly legal. In 2013, former head of the U.S. Mint Philip Diehl said that U.S. law plainly empowers the Treasury secretary to mint the coin, even if Congress did not intend to delegate that authority. Republican Senator Mike Lee, meanwhile, has tacitly affirmed this view by introducing legislation that would eliminate the platinum-coin option — a bill that wouldn’t be necessary unless existing law blessed the maneuver.

Wait: Wouldn’t the amount of platinum needed to mint a coin worth $1 trillion be heavy enough to sink the Titanic?

This is a common misconception. And it led the National Republican Campaign Committee to raise this totally good-faith objection to minting the coin in 2013:

If it were the case that the U.S. government needed to amass $1 trillion worth of platinum on commodity markets in order to mint a $1 trillion coin — and if that amount of platinum were indeed too heavy for even the finest luxury cruise ships of the early 20th century to carry — then that would be a big problem, especially given the current state of the global shipping industry.

Fortunately, this is not how monetary sovereignty works. A $1 trillion coin would require no more platinum that the Treasury Department says it does.

Joe Biden’s other options for cleaning up Congress’s mess

The president has (at least) two other options for unilaterally averting a debt default. For one, he could invoke Section 4 of the 14th Amendment, which declares, “The validity of the public debt of the United States, authorized by law … shall not be questioned.” In the view of some legal scholars, this text renders the debt ceiling unconstitutional. And the president has an obligation not to honor unconstitutional laws. So, Biden could invoke Section 4 and his Treasury Department could simply continue making all payments unless or until the judiciary ordered it to stop. But it’s not obvious that anyone would have standing to sue the president in this circumstance. Some Democratic Party bigwigs encouraged Obama to consider this route in 2011 and 2013.

A similar, if slightly less dramatic, option would be for Biden to declare ignoring the debt ceiling the “least unconstitutional” of his options. This option derives from the fundamental contradiction that a debt-ceiling breach creates: On the one hand, Congress has ordered the president to execute an amount of spending that requires issuing new debt. On the other hand, Congress has ordered the president not to issue as much debt as its mandated spending requires. In this circumstance, there is no way for the executive branch not to exceed its constitutional authority. Either it nullifies duly passed spending legislation, or it ignores duly passed debt-ceiling legislation.

Given this Catch-22, some legal scholars argue that ignoring the debt limit would be the least unlawful of Biden’s options.

The constitutional arguments behind both these options strike me as sound. And minting the coin looks unambiguously legal. But if Biden were to take any of these actions, it is all but certain that Republicans would at least try to engineer a legal challenge. And so long as there is any uncertainty surrounding the legality of America’s debt payments, some of the negative impacts of breaching the debt ceiling might still be felt. Investors would likely want some premium for accepting the risk that conservative judges would upend America’s finances at any moment. Thus, interest rates could rise, slowing economic growth.

Only congressional action can fully eliminate the threat that the debt ceiling poses to the U.S. economy. But if the legislative branch proves incapable of averting economic self-sabotage, the Treasury Department might need to lend it some change.