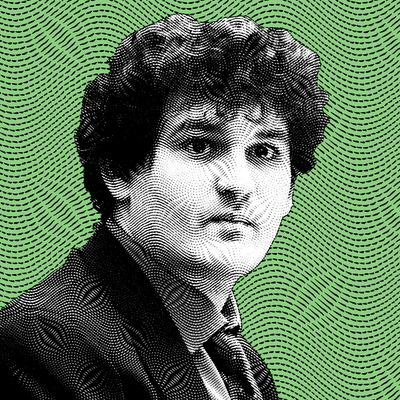

Strip away all the rhetoric around crypto — all the puffery about democratization, decentralization, freedom, and everything else — and the cold, hard reality about the market is that it has always been a race to be the biggest billionaire, to have the most powerful monopoly, to control more than anybody else before it was too late. For the last few years, two of its most powerful players have staked out different ways to get to be the Crypto Godhead. There was Sam Bankman-Fried, a former hedge-fund trader turned CEO of crypto exchange FTX — the company that had naming rights for the arena where the Miami Heat play. He was Mr. Approachable, happy to look like a zhlub sitting next to a still-married Gisele Bündchen, and was trying to put his stamp on elections and Wall Street without getting a haircut or bothering to put on long pants. Then there was Changpeng Zhao, CEO of Binance — the world’s largest crypto exchange. Known as CZ, he was more removed, less interested in making policy than dodging it. For a while, the two were intertwined — CZ investing in Bankman-Fried’s exchange, and both reaping the benefits of that cooperation before going their separate ways.

It all came to a head on Tuesday, November 8, when Binance bought FTX — a company that was worth $32 billion several weeks ago — because, as CZ put it, there was a “significant liquidity crunch.” In other words, FTX had run out of money. Like with previous crypto wipeouts, things cratered fast. In the last few days, Bankman-Fried has been brought low by a series of leaks about his businesses’ financial health with CZ stoking concerns online and making material efforts to deepen his competitor’s problems. It recalls in some important ways the earlier blowup of terra and luna coins and the implosion of Three Arrows Capital that followed, but it has the potential for being even more widespread. As it stands now, CZ is suddenly the undisputed ruler of the crypto universe.

The backstory of how all this happened is complicated, but central to it is Bankman-Fried’s hedge fund, Alameda Research, which recently had about $15 billion in assets. The hedge fund has been in trouble before and was accused of market manipulation (the suit was later dismissed). But on November 2, crypto news site CoinDesk published an explosive leak showing that most of the fund’s money was a digital token issued by FTX, Bankman-Fried’s exchange. (That token, known as FTT, is used as a funding source to pay back people who take money out of the exchange.) There were other questionable revelations: How did Alameda claim to have $5 billion worth of the FTT token when the total market was just a little over half that? The fund owed more to others than it had in forms of money not created by Bankman-Fried. All of a sudden, the question became “Is Alameda Research insolvent?”

Because this is crypto, it all starts to get (even more) complicated fast, but the main problem boils down to the same one behind every bank run. No exchange — not even NASDAQ or the New York Stock Exchange — keeps enough money to pay everyone if all investors pulled their money at once, and FTX was no different. If a huge chunk of Alameda’s money was created out of thin air by an entity controlled by Bankman-Fried, then how much of Alameda’s size was real? More important, it exposed a flaw in FTX’s relationship with the hedge fund: If the value of FTX’s digital currency started to drop, the exchange would suddenly have less money to pay the people who use it.

Enter CZ. It turns out that last year, Bankman-Fried had bought back Binance’s stake in FTX and paid the company more than $2 billion using tokens issued by FTX and Binance. (The split on that isn’t clear.) Regardless of the actual dollar amount, CZ now had the means to tank FTX. On November 6, the Binance founder essentially signaled that he had no confidence in the Bankman-Fried operation and would start selling off the FTT token — the very one that Bankman-Fried had used to buy back shares of his own company from CZ.

This matters because the CEO of Alameda, Caroline Ellison, tried to swat the rumors away, saying that the leaks didn’t reflect all of Alameda’s money, and offered to buy all of Binance’s FTT at $22 per token (it is trading at less than $10 as of this writing). The attempt to keep things from spiraling, however, didn’t work. The next day, Bankman-Fried took directly to Twitter to calm what was apparently a run on his exchange.

By Tuesday, it was clear that, regardless of what money Bankman-Fried controlled, the markets didn’t trust him anymore. The value of FTT kept plunging — down nearly 90 percent from highs of nearly $80 last fall. Investors pulled essentially all of their money out of FTX. By late morning, CZ and Bankman-Fried had announced that Binance had taken over FTX.

From a broader perspective, it’s hard to overstate how big of a reversal this is. It was not long ago that Bankman-Fried was the “Next Warren Buffett”:

Bankman-Fried was the crypto superhero who was swooping in to save other insolvent players that had collapsed in the wake of the Three Arrows Capital collapse. That narrative only held up for a few months, then imploded. It has crypto insiders wondering, If things keep on going this way, who’s going to swoop in and save CZ?