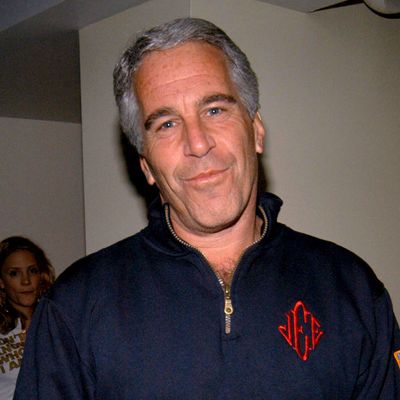

Jeffrey Epstein kept much of his money at JPMorgan Chase for 15 years, and this week, the bank’s efforts to keep information about that relationship private ran into new challenges. On Monday, prosecutors for the U.S. Virgin Islands — which is accusing the bank of facilitating Epstein’s child-sex-trafficking operation in a civil suit in Manhattan federal court — filed a series of exhibits with hundreds of new emails between Epstein and the bank officials, showing that the relationship between the bank and Epstein was deeper than previously known. Prosecutors have also accused the bank of slow-rolling the production of documents, which has allegedly stymied the rest of the fact-finding process — including, most crucially, a May 26 deposition of Jamie Dimon, the bank’s longtime CEO. Prosecutors are now trying to get another shot at deposing the billionaire banker based on the new information, and the judge overseeing the case later granted the government a victory by giving them a look at his preparation material for answering questions about Epstein. So far, the more information that’s come out in this case, the worse it’s looked for the bank — and these new revelations continue that pattern.

For Dimon, the potential for a second deposition is embarrassing. It implies that his bank hasn’t been forthright with producing material. But it goes beyond that. The question of what Dimon knew (or didn’t know) about Epstein has always been at the center of the case. The chief piece of evidence tying him directly to Epstein was an email from a lower-level staffer saying that Dimon would have had to approve a $120 million transfer out of Epstein’s account — but that’s not much a smoking gun. (The bank’s spokespeople have been saying Dimon wasn’t aware that Epstein was a client and that there’s no evidence that he had reviewed anything about the accounts.) So far, there has been no obvious fact that’s contradicted the bank’s version of events. Epstein was certainly a client, but this is the country’s largest bank we’re talking about — there were a lot of clients, and Epstein didn’t matter to the bank’s overall business. Since 2019, JPMorgan Chase has undertaken its own investigation into Epstein’s relationships throughout the bank, called “Project Jeep,” though the conclusions of that investigation aren’t yet known.

The new evidence in the Virgin Islands suit arguably speaks directly to that question, however. All told, Epstein had direct contact with at least a dozen of the bank’s employees, ranging from those in the highest deal-making echelons to grunt workers and personal assistants. He appears to have wielded the greatest influence through Jes Staley — the head of the wealth and, later, investment-banking divisions. Through Staley, Epstein pushed the bank to do deals with China and the United Arab Emirates and even facilitated a deal for Leon Black, the disgraced former head of private equity firm Apollo, to buy Edvard Munch’s The Scream. Dimon’s former counterpart, Alan “Ace” Greenberg, the now-deceased former head of Bear Stearns, had personally requested “an exception to the felony policy” for Epstein, a former Bear Stearns client, at JPMorgan, according to newly released emails. (Bear Stearns was acquired by Dimon’s bank during the 2008 financial crisis.) Even though Epstein’s direct accounts would have been less than a rounding error for bank, his intangible value to the firm may have been higher.

What Staley allegedly got from Epstein has largely been drawn from court documents already made public — girls, money, influence. Epstein sent Staley pictures of models, coordinated schedules with Prince Andrew, and at one point wired money to a girl after confirming that Staley would be visiting. Staley talks about going to visit Epstein’s island and spend time on his yacht even when Epstein wasn’t there. During a period when Epstein was under increasing press scrutiny for trafficking young girls, they both appear to have affirmed their commitment to each other as “family.” “I realize the danger in sending this e-mail. But [it] was great to be able, today, to give you, in New York City, a long heartfelt, hug,” he wrote, apparently acknowledging that Epstein had violated the terms of his probation for his 2009 conviction by leaving Florida.

But Staley appeared to get much more than hugs — he also got business advice and connections from Epstein. “Your first great move should be a new China initiative. First it was alternative investments, now China. You should have a dedicated China entity, with its own board of advisors, should include China politicos. They love to travel. You should be their link to Treasury,” Epstein wrote on October 23, 2009 — soon after Staley was promoted to head of investment banking, according to a 23-page exhibit filled with emails between Epstein and Staley, as well as other business associates. Four days later, Epstein lays out “the steps necessary for JPMC to expand its business in China down to details surrounding culture, office locations and suggestions for approaching government officials.” He goes further to offer fixers that would help ingratiate him with China’s elite. (It’s unclear how much Staley actually followed up on this or whether Epstein’s advice was actually helpful. JPMorgan’s “Sons And Daughters” pay-to-play campaign, in which the bank hired Chinese officials’ children in order to secure business in the country, dated back to at least 2006. The program was revamped in 2009 to “directly link referral hires to new investment banking deal business,” according to the Security and Exchange Commission’s order censuring the bank on the program.) In 2011, Epstein appears to have brokered a meeting between Staley and Benjamin Netanyahu, prime minister of Israel, according to the exhibit. “Surprise surprise,” Epstein said to Staley after the banker had informed his friend of the meeting. And Epstein tried repeatedly to set up a deal so China would buy ports in Dubai and tried to connect him with Sultan Ahmed bin Sulayem, the head of the Emerati company that controls those ports.

The list goes on. The dozen or so JPMorgan employees who are named in court documents as having dealt with Epstein directly include Staley’s successor, Mary Erdoes, and other high-ranking members of the bank’s investment-banking and legal departments. JPMorgan declined to comment about the documents, and Staley’s attorneys didn’t return a message seeking comment.

For his part, Staley appears to have supplied Epstein with confidential information from inside JPMorgan, including nonpublic deal information, an announcement that he was getting promoted to the head of investment banking, and even internal deliberations about dealing with Middle Eastern countries. The Virgin Islands alleges that all of Epstein’s largesse toward Staley was done in the service of having the bank look the other way with regard to his sex-trafficking conviction and that it appears to have worked — at least for a while. Internal emails from the bank’s security note that Epstein is “alleged to be involved in the human trafficking of young girls” but is an “alleged personal associate of the CEO of the Investment Bank (Jes Staley),” according to another court exhibit, which focuses on the allegedly thwarted attempts by the bank’s compliance personnel to fire Epstein as a client.

By 2021, Staley’s relationship with Epstein would prove to be a pivotal factor in him losing his job as the CEO of another bank, Barclays. JPMorgan has already apologized for its relationship, and it offered to pay as much as $290 million to Epstein’s victims in a private suit. But it looks like Dimon is still going to have to answer uncomfortable questions about why Epstein was able to get so deep inside a world-class bank. Hanging over this suit is the question of what the ultimate consequences will be for JPMorgan. Even if Dimon knew about Epstein, his culpability here pales compared to Staley’s, and it’s practically unimaginable that the bank’s board would oust him. Still, the more information that’s been revealed about the bank’s relationship with Epstein, the less believable it is that he was just another client.