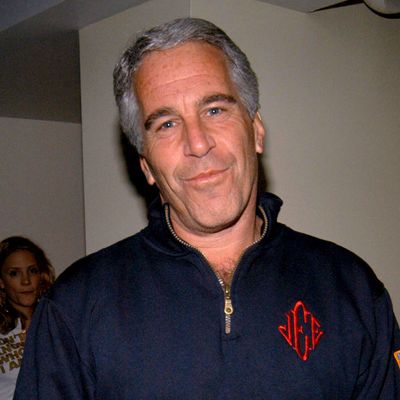

When piecing together the history of how Jeffrey Epstein was able to run a child-sex-trafficking operation for decades, 2006 stands out as a pivotal year. That was when a federal investigation into him began, his compound in Palm Beach was raided, charges were filed against him for soliciting underage girls for prostitution, and the FBI started its own investigation. But up in New York, executives at JPMorgan Chase were making decisions about Epstein that would prove to have much longer-lasting effects. At the time, Epstein had an account with about $32 million and routinely withdrew as much as $70,000 at a time — and had already taken out $750,000 by that October, according to court documents. Despite the charges, the bankers — including asset-management-division CEO Jes Staley and private-bank CEO Mary Erdoes — decided they would keep him as a banking client, though, they would “not proactively solicit new investment business from him.” But even that caveat didn’t hold, and five years later, Epstein was again working with Staley and Erdoes to start a new investment together with Bill Gates’s charitable foundation.

The public knows this now because of a lawsuit filed by the U.S. Virgin Islands against JPMorgan Chase over its long relationship with Epstein. On Tuesday, the bank settled with the Virgin Islands’ Attorney General’s office for $75 million — $20 million of which will go to charities, with another $10 million for a victims’ mental-health fund and about $20 million going to lawyers’ fees. The bank also agreed to implement stronger human-trafficking controls. The agreement was a surprise for a suit that had revealed so many explosive details about the way that wealth and power worked around Epstein, who ensnared not only some of the most powerful people at JPMorgan Chase but bankers at Goldman Sachs and the former head of the CIA. In fact, its conclusion is the real beginning of the end into the official inquiries into the cabal of wealthy and powerful people who helped make — and who benefited mightily from — Epstein’s monstrous crimes.

It’s tempting to see this settlement as another example of Epstein’s uncanny ability, even in death, to disappear information about himself. A civil suit against JPMorgan brought by his victims? Settled for $290 million. How about Deutsche Bank, where he banked later on? $75 million. Why did Leon Black pay $158 million to Epstein, who was not a banker or an accountant, for tax and financial advice? The answer to that question cost Black $62.5 million. To this day, the only person who has been held criminally responsible for Epstein is Ghislaine Maxwell, who will likely die in prison. Even the Justice Department’s own report on how Epstein was able to die in prison wasn’t exactly clarifying.

But it’s also not quite right that we don’t know now how Epstein was able to do what he did. In fact, this suit was one of the most damning for showing how powerful people shrink from responsibility when they have even the slightest chance to make more money. Here is just a small amount of what the public knows now that it hadn’t at this time last year:

Epstein bought some of Wall Street’s most powerful people’s loyalty by bringing them clients with immense wealth and power, like Google cofounder Sergei Brin.

Staley, who referred to encounters with “Snow White” and a “Beauty and the Beast” facilitated by Epstein, won internal battles over keeping him as a client after trafficking issues were raised.

Erdoes, who has long been seen as a possible successor to Jamie Dimon, was key to JPMorgan keeping him. According to court documents, she sought out his tax advice, fought to keep his referrals under her authority, and even advised him on which accounts he should take money out of and when. When Epstein emailed her about a deal, saying it was “time to make some real money,” she responded: “Onwards and upwards on so many fronts.”

Epstein had brokered giant deals, including Black’s purchase of Edvard Munch’s The Scream.

Staley had apparently plied Epstein with insider information, and appeared open to his advice about running the bank in China.

The U.S. Virgin Islands v. JPMorgan Chase was always a civil case, so it would not have sent anyone to prison. But what the settlement is depriving the public of is culpability. It didn’t even include an agreement of liability — in other words, an admission of wrongdoing — though the bank said it “deeply regrets any association with this man, and would never have continued to do business with him if it believed he was using the bank in any way to commit his heinous crimes” — despite evidence showing that the bank’s head of security raised those very issues. (A separate but related suit between JPMorgan and Staley was also settled, though its terms are confidential.) Just last year, Erdoes made $20.5 million in total compensation — about as much as she’d made during each of the past three years. It’s now up to the bank to decide whether she, and the rest of the executives still there who worked with him, will be around to make sure that they don’t do it again.