When Mark Cohen, lawyer for Sam Bankman-Fried, first got his chance to cross-examine Caroline Ellison on Wednesday afternoon, his first line of questioning to the blockbuster witness was about … internal labels for bank accounts. He asked whether Alameda Research, the Bankman-Fried owned hedge fund where Ellison was CEO, tracked where its money went, and appeared surprised when she said yes. He didn’t know why certain accounts were named one way internally and another way on the website. “Objection, your Honor,” said prosecutor Danielle Sassoon: “This is confusing.” Judge Lewis Kaplan agreed, and the session ended for the day: “I have the feeling that if we broke now and started in the morning, Mr. Cohen, you’d be happier, everyone would be fresher, and this could get sorted out overnight, right?”

On Thursday, things didn’t go much better, and Ellison, who did serious damage against Bankman-Fried, left the witness stand before 3 p.m. basically unscathed. The morning session was slow and undramatic, with Ellison admitting that, sometimes, Bankman-Fried would not be that involved in the company — an general statement that didn’t really do much to address many of the allegations of when he was directly accused of committing fraud. The cross-examination was so scattershot and confusing that the Associated Press made Cohen’s performance the subject of its headline. There were times when Judge Kaplan had to ask where Cohen was going, or what these questions were all about, according to the report.

All in, Ellison spent about 13 hours on the witness stand — most of that time answering questions from the Justice Department. (Remember, she has already pleaded guilty to seven counts of fraud and conspiracy, and is facing about 50 years in prison, but has a cooperation agreement that can lead to her serving far less time, or none at all.) Much of it was dry; it was occasionally very dramatic. Overall, she made a very clear case for Bankman-Fried’s guilt.

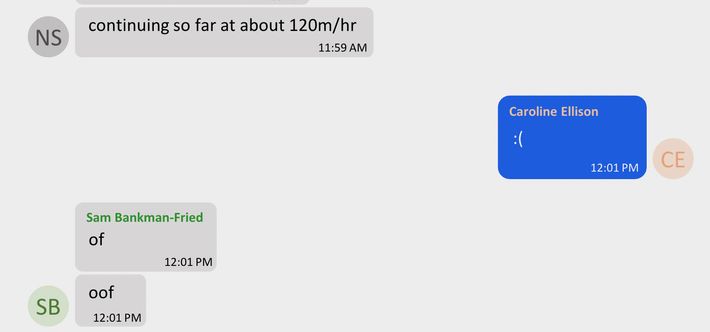

But there was one moment that, I thought, really got to the heart of who she was. Last November, Alameda and FTX — Bankman-Fried’s crypto exchange, from which Alameda allegedly stole customer funds — were collapsing, it became clear to a group of insiders that it was over. A group in Bankman-Fried’s inner circle discussed the run on funds over Signal, the messaging app. Nishad Singh, the head of engineering at FTX, wrote that the exchange was losing $120 million an hour, and they were effectively facing bankruptcy. Here’s how Ellison responded.

“You wrote back with a sad face. Why did you write a sad face?” Sassoon asked her. (At this question, the overflow room on the court’s 23rd floor — full of reporters and interested normies — burst out laughing.)

Bankman-Fried is arguing that Ellison was the true mastermind here, the real power that secretly stole more than $8 billion in customer funds. Ellison’s answer, that she was “terrified,” is almost beside the point. That’s $2.8 billion a day. When you know you don’t have the money. And she responds with an emoji? That she’s frowning? How do you defend your client against that?