Last month, consumer prices in the U.S. rose at their fastest rate in 40 years.

And virtually all of that inflation came before the world’s third-largest oil exporter invaded its fifth-largest wheat producer, and the West proceeded to evict the former from the global financial system.

Now, global wheat prices are 40 percent higher than they were in mid-February, and oil prices are up 20 percent over the same period. Meanwhile, COVID outbreaks in China are bringing lockdowns back to the (woefully undervaccinated) workshop of the world. Americans were already losing patience with rising prices before these shocks to global commodity and manufacturing markets. As the costs of food and energy surge, calls for relief are reaching a fever pitch. The American people want their pre-pandemic economy back, the one that combined low unemployment with stable prices.

Responsibility for restraining inflation — without killing the recovery — has fallen on the Federal Reserve. Earlier this month, the central bank raised its benchmark interest rate by 0.25 percent. It has subsequently signaled that it will execute a rare 0.5 percent rate hike in May and continue raising rates throughout the year until they’ve risen a cumulative 2.5 percent by 2022’s end.

If this policy works as intended, it will slow U.S. economic growth without stalling it. The theory of the Fed’s case goes like this: As the cost of credit rises, households and businesses will engage in less debt-financed consumption and investment and in more saving. This will prevent the gap between demand and supply from widening amid economic shocks that constrain the latter. As demand moderates, price growth will slow. But this entire process will be so gentle and gradual that economic growth will never turn negative, and unemployment will not substantially rise. The economy will add jobs more slowly, but it will not lose them. From the vertiginous highs of contemporary inflation, the U.S. will enjoy a soft landing back on the stable ground of a 2019-esque economy.

Unfortunately, there’s cause for doubting this story’s plausibility. Simply put, there is little evidence that the Fed knows how to reduce prices without bringing the economy down with them.

Since 1961, the central bank has sought to curb inflation with a spree of rate hikes nine times. As Politico’s Ben White notes, on eight of those occasions, the Fed’s tightening led to a recession. The one exception is 1994, when the Fed implemented a series of sharp rate hikes that yielded lower inflation — but no recession — over the ensuing years. This success helped establish then–Fed chair Alan Greenspan’s reputation as an economic maestro.

Yet even this golden exception comes with asterisks. Rate hikes are supposed to reduce inflation by slowing the growth of demand for labor and production. And yet after Greenspan began tightening in 1994, output and employment both grew at a faster rate than they had been previously. Inflation, meanwhile, did not start falling substantially until nearly two years later, at the tail end of 1996. These facts raise the possibility that America’s soft landing from the inflation of the early 1990s had little to do with Fed policy.

As J.W. Mason notes, U.S. inflation began falling in 1996 right when oil prices peaked — and then started rising again in 1999 at the precise moment when oil prices were rising again.

No one thinks that the Federal Reserve sets oil prices, which are largely determined by global economic forces and geopolitics. Yet oil is such a critical input for so many forms of production that it is plausible that rising oil prices could yield widespread inflation. Thus, the one supposed precedent for the Fed using tight money to moderate inflation — without inducing recession — might be nothing of the kind. In truth, the central bank’s contractionary monetary policy might have been overwhelmed by inflationary economic forces until an unrelated drop in oil prices did Greenspan’s job for him.

The notion that benchmark interest rates do not have a major impact on demand and, thus, on inflation — unless the Fed raises rates high enough to induce a recession — may be counterintuitive. But there is some evidence to support it.

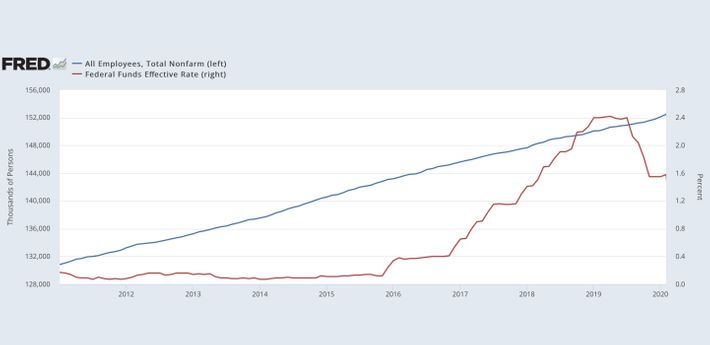

The Fed’s last tightening cycle ran from the end of 2015 into 2019, when the central back reverted to lowering rates. As Mason observes, throughout that period, America’s rate of employment growth remained virtually constant: Higher interest rates did not correlate with slower job gains, and lower rates did not yield faster ones. Erase the red line from this chart and you’d have no way of ascertaining when the Fed’s tightening cycle occurred.

We do not have access to the counterfactual, of course. In the absence of the Fed’s tightening, employment growth might have started accelerating in 2016. It’s possible that the central bank’s rate hikes contributed to a falloff in business investment that year (though such investment rebounded before the Fed’s bout of tightening ended). Regardless, to the extent that the central bank’s rate hikes suppressed demand and inflation in 2016 through 2018, they did so only marginally. Apply those results to the present context of near-8 percent inflation and the impact would be negligible; price growth would remain exceptionally high.

And that is all the more true when one considers the peculiar nature of today’s price growth. Contemporary inflation is, in large part, the product of a sudden change in the structure of consumer demand. In response to the COVID pandemic, consumers throughout the world simultaneously shifted their spending away from in-person services and toward manufactured goods. Producers had no way of anticipating this development. As a result, the supply of myriad goods has failed to keep pace with demand, leading to price increases.

At the same time, inflation in the service sector has been tepid. Nonhousing services are witnessing price growth that barely exceeds the Fed’s desired 2 percent rate.

Unfortunately, a recent study from the Bank for International Settlements indicates that monetary tightening has a bigger impact on the service sector than the goods one. Examining the interaction between prices and interest-rate policy in the U.S. since the early 1990s, the BIS researchers found that monetary policy demonstrated a strong influence on “a remarkably narrow set of prices, concentrated mainly in the more cyclically sensitive service sectors.” The paper specifies that this was not the case during earlier, higher-inflation eras of U.S. economic history. Nevertheless, the research raises the possibility that the Fed’s impending rate hikes may be most effective where they are least needed.

To be sure, there is no shortage of precedents for the Fed dramatically reducing overall prices through interest-rate policy. In virtually every case, however, rate hikes reduced inflation by triggering an economic downturn. In other words, the Fed made goods and services more “affordable” by rendering millions of Americans too poor to bid up their prices.

If Mason and other like-minded economists are right — and the impact of benchmark interest rates on inflation and growth is overhyped — then we probably don’t have to worry about a Fed-induced recession anytime soon. The central bank is not yet contemplating the draconian rate hikes that Paul Volcker enacted in the early 1980s. In fact, the Fed is currently poised to keep benchmark interest rates well below the likely rate of inflation through the end of this year.

If the Fed has only a very limited capacity to mitigate inflation in non-recessionary ways, however, then other policy-makers will need to step up to the plate. Today, the cost of rental housing is rising by nearly 6 percent, largely because America has long failed to build enough housing to keep pace with demand, especially in job-rich metro areas. Jerome Powell cannot conjure new housing developments by nudging up mortgage rates. Only land-use reform and public investment can produce abundant housing and, thus, lower rents. The Fed does not even pretend to control energy prices. Yet few forms of inflation weigh more heavily on America’s household budgets than rising gas bills. Only measures that incentivize across-the-board energy production in the short term, and green technology in the long run, can slash the cost of fuel.

Beyond addressing sector-specific supply constraints, it may also be necessary to suppress broad-based demand, especially if inflation outlives the Ukraine crisis (or if that crisis persists indefinitely). But there are surely more targeted and effective ways of doing this than fiddling with interest rates. For example, Congress could pass legislation forcing (or strongly encouraging) workers to save a fraction of their paychecks in interest-bearing accounts or government-guaranteed investment vehicles.

Such reforms may not be politically tenable today. Given our existing balance of power and array of institutions, raising interest rates may be the best anti-inflation tool we’ve got. But that is itself a kind of crisis. We can’t afford to keep relying on policy instruments that are more familiar than effective. The price of complacency is too damn high.