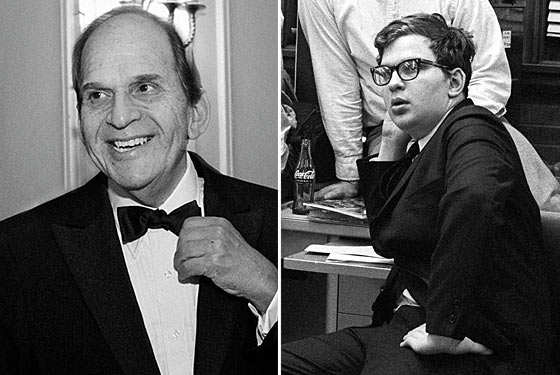

Bruce Wasserstein, the owner of this magazine who died last week at 61, was, above all, a thinker. “The only thing we do here is think a little bit,” he liked to say after he arrived at Lazard, where he served as CEO since 2005. Bruce’s prodigious brainpower was contained in what was, for one of the leading investment bankers of his era, an unlikely and endearingly human package. His rumpled suits were a trademark from his earliest days (and to journalists like us, reassuringly familiar); his aversion to small talk and occasional social awkwardness, so unlike the slick rap of the stereotypical I-banker, gave his words, when he spoke, an authentic and persuasive authority.

For Bruce, deal-making was about creativity as much as money. These were real-life dramas, and he was the director and sometimes leading man. He and his sister, the Pulitzer Prize–winning playwright Wendy Wasserstein, were sometimes portrayed as polar opposites, the bohemian and the banker, but they were actually quite similar. “Bruce is very creative,” she once said. “He would tell you that what he and I do is not actually so different. Of course, I would tell you that he made up the three-tiered deal, but I couldn’t tell you what it is.”

Bruce had always been a prodigy, graduating from the McBurney School at 16, the University of Michigan at 19. At 23, Wasserstein earned a joint degree from Harvard Business and Law Schools, later taking a fellowship at Cambridge to study British mergers; in 1971, he joined the law firm Cravath, Swaine & Moore. It was there that he met Joseph Perella, who then ran First Boston’s small M&A shop. “I said to myself, ‘Holy mackerel, this guy is unreal,’ ” Perella has said. He brought him to First Boston in 1977; a decade later, the two founded Wasserstein Perella. Together, they changed the investment-banking business.

A former Yeshiva student, Bruce loved the law for its Talmudic intricacies, but the deal was a richer thing, an engrossing multidimensional game with an infinite variety of tactics and strategy and, just as important, a human element: winners and losers, glory and failure. As much as anyone, Bruce made corporate finance one of the central dramas of American life, a long-running opera with plot twists and blunders, surprise endings and its own jargon, which, along with the tactics the words described, he helped to write.

These were giant, pressure-packed deals—Bruce engineered some of his era’s major corporate reconfigurations, involving RJR Nabisco, Kraft, and Warner Bros.—and yet Bruce became known for his preternatural calm. “When the rest of the world was freaking out,” recalls an investment banker, “he would get really quiet and calm, an oasis in the maelstrom.” Bruce recognized this as a gift: “You see all this noise around you, so the reaction is just to hmmmmm and be very calm. I find that much more relaxing than dealing with my kid who’s just bumped into the wall or something.”

In 2002, after the sale of Wasserstein Perella to Dresdner Bank, Michel David-Weill came calling. Lazard, which his family had controlled for generations, was coming apart; he thought Bruce could save it. Bruce quickly quelled the infighting. He had a nose for and deep loyalty to talent, and ushered in his people. “Once he decided you were deserving of his confidence, he’d stick with you through thick and thin,” says Jeffrey A. Rosen, a deputy chairman of Lazard, who worked with Bruce for 30 years. Then, with characteristic boldness, he took the company public, bringing the firm back from the brink, an unlikely success story.

Throughout, there was his formidable family. His parents were both Polish émigrés; his father, Morris, who arrived at Ellis Island in 1927, started a ribbon company with his brothers and began a large family. Bruce had a large and loving family himself (which got larger when he brought Wendy’s daughter in to live with them after her mother’s death in 2006); Bruce’s strong sense of his roots and familial legacy can be seen in the scholarships and chairs and philanthropic gifts he often set up in his father’s name.

In 2004, Bruce bought New York Magazine. Typically, the deal that brought him the property was dazzling—he swooped in and snatched it at the last minute. Some—indeed some of us—wondered what he wanted from the magazine. But as we got to know him, it became less mysterious. Journalism was a first, and lasting, love. As an undergraduate, he’d been executive editor at the Michigan Daily, as well as a rabble-rousing columnist.

Other powerful men might have used a magazine like New York to wield influence; Bruce would have none of that. At monthly meetings, he fired questions, but never gave directives. He trusted our judgments, and if he thought we sometimes failed to earn that trust, he never let on. For a man with such a serious reputation, he laughed a lot, a deep-throated guffaw that settled down into a cartoon-size grin. He knew the magazine would occasionally cause him trouble in his social set; secretly he seemed to enjoy that. He’d bought the magazine as an investment, but there is no denying that for him, owning it was partly its own reward. He had copies of it strewn somewhat incongruously (Cheap Eats?) all over his lavishly appointed Lazard offices; for those who worked here, his obvious joy in the magazine was motivating, even oddly intimidating. Bruce understood the powerful tradition of the magazine he owned, and fully appreciated its place in the city where he invented himself, and in turn helped to invent. For all his legendary complexities, his involvement with this magazine was pretty simple—he wanted to build the best possible future for this company. In that sense, New York could not have had a more perfect owner. In every possible way, he will be missed.