It wasn’t even two years ago that, according to his lawsuit, the idea for Snapchat came to Reggie Brown. Brown was a junior at Stanford, an English major (a “fuzzy,” in campus parlance, as contrasted against the “techies,” who are Stanford’s superstars)—and Kappa Sigma brother. One night, according to one account, he and a friend were joking about sexting, and he came up with the idea for an app that could send dirty pictures from mobile devices and then—the part that puts the killer in killer app—make them disappear from a recipient’s in-box a few seconds after they were viewed. For one thing, it was a game changer for hookups, an admirable accomplishment for a member in good standing of “a house that’s sort of known for having a lot of wild guys who wear Brooks Brothers,” according to Miles Bennett-Smith, the editor-in-chief of the Stanford Daily. And it was worth money.

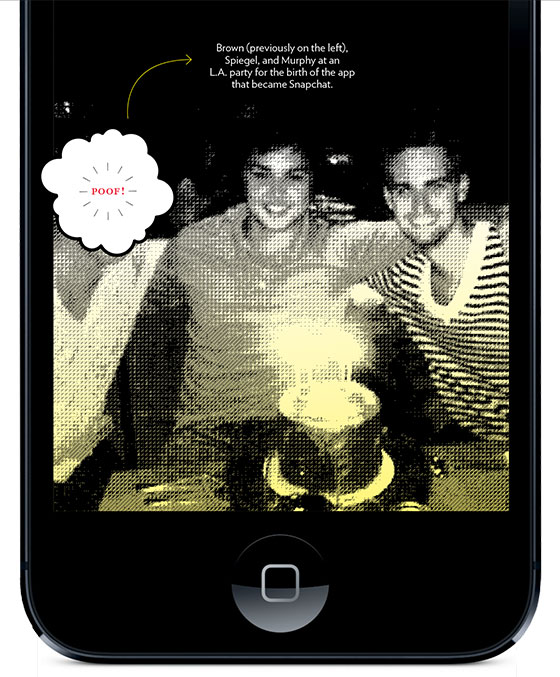

The complaint states that he took the idea to Evan Spiegel, a fellow Kappa Sig majoring in product design and known for his ambition. “He’s a really, really driven guy,” said Bill Burnett, an engineering professor who was Spiegel’s adviser, admiringly. Like many of his Stanford classmates, Spiegel was, for all intents and purposes, a professional, very much the norm at Stanford nowadays. Spiegel had already absorbed a thorough preprofessional curriculum and even attempted a start-up called Future Freshman. He knew anything that enabled the social lives of young adults, as played out on a mobile device, meant money. According to Brown’s lawsuit, Spiegel called it a “million-dollar idea.” Soon, they enlisted a third brother, Bobby Murphy, as a partner because he was a computer-science jock who could write code. The app was launched in July 2011, found a foothold among teenagers in Southern California that summer, and as of last month was being used to send 60 million messages a day. Though it hasn’t generated any revenue yet, Snapchat recently raised $13.5 million in venture capital and boasts a valuation of $60 million to $70 million.

College classmates and frat brothers lose touch, find other interests, realize how different they really are—though in most previous cases, millions of dollars weren’t at stake. The three spent the summer together, working on their new venture at Spiegel’s father’s house in Pacific Palisades. (John Spiegel is a high-powered lawyer—and former Stanford tennis star—who made Hollywood news for his crushingly effective counsel to Warner Bros. in the firing of Charlie Sheen from Two and a Half Men.)

But Brown, the English major, gradually became estranged. Billy Gallagher, former editor of the Stanford school paper, reported in the industry blog TechCrunch that while Spiegel and Murphy toiled away at their respective métiers, Brown privately acknowledged having “a little less to contribute” than the others and “would go out constantly, partying at all hours and not working on the app.”

All that Brown’s fuzzy skills earned him were start-up grunt work: writing up the terms of use and answers to consumers’ frequently asked questions. The falling-out reportedly occurred after he fought with Spiegel and Murphy over the order of their names on the patent application.

“This is a case of partners betraying a fellow partner,” reads the opening sentence of his complaint, which alleges that in August 2011, when Brown took a short break to visit his parents in South Carolina, Spiegel and Murphy stopped answering his messages, blocked his password from accessing the system they’d built, then had a “threatening” letter sent on their behalf from the “international law firm” Cooley LLP.

And thus has Frank Reginald Brown IV, the son of a pediatrician in South Carolina, joined the ranks of tragic Internet-age figures: people who missed out on millions of dollars because somebody else found breakaway glory with their can’t-fail idea. Not that they ever look quite like losers. The Winklevoss twins, of Facebook and The Social Network, are the poster boys for this sort of hard luck: handsome, wealthy, clubbable types from Greenwich who failed to master the new technologies growing around them because they were busy training to row for the U.S. Olympic team. And they harbored enough of a naïve belief in the gentlemanly rightness of institutions that they first appealed to Harvard’s president (before launching their series of lawsuits) when they felt Mark Zuckerberg had stolen their idea.

The plight of the Winklevosses (they made maybe $65 million for their efforts) and the vanquishing of these comically entitled preppies by Zuckerberg, a nerd in a hoodie, a misfit, possibly on the spectrum, represented a thorough upending of status hierarchies.

The battle for Snapchat looks on its face exactly like that over Facebook. But there’s an important difference that illustrates exactly where we are in this era of entrepreneurship: Zuckerberg was as mixed up as any college sophomore when the idea for Facebook fell into his lap. Sharklike as The Social Network made him appear, he seems an innocent compared with the predators of now. Mark Zuckerberg showed, among other things, that college was not only a place for learning—if you kept your eyes open, you could get rich upon graduation.

Hand-wringing about what’s lost when a college education comes to function as ultra-high-end vocational training is, of course, a favored fuzzy pastime—and a sucker’s game. Even professors have gotten the message. “For the humanities, it’s reached the point where we have to market ourselves to justify reading Homer,” says Richard Martin, a professor of classics. “It’s not an easy sell to 20-year-olds who are so involved in the invention or marketing of the latest widget. A trope of the administration is to tell them you should read The Odyssey because it encourages creativity, which means you might invent the next Google. There’s always got to be a point with this student body.”

What seems most difficult for these undergrads to learn is that this era of apps worth millions or billions may someday end. “I tell them, every tech company goes out of business eventually,” says Burnett. “But it’s hard for 20-year-olds in this environment to have a lot of perspective about business cycles.” That may be a harsh lesson, when it comes. In the meantime, the fuzzies might be prudent to travel with attorneys.

Have good intel? Send tips to [email protected].