One Monday in June, a team of young data researchers gathered in the conference room of a Boston start-up called SpottedRisk to talk about celebrities who’d gotten themselves into trouble. Operations analyst Franki Slattery began the meeting by ticking off a couple of updates: Cuba Gooding Jr. had been arrested for allegedly groping a woman at a bar; soccer star Cristiano Ronaldo’s civil rape lawsuit had been moved to federal court.

Other “disgrace events,” as Slattery called them, were harder to categorize. Rapper Lil Xan had pulled a gun on someone at a 7-Eleven over a dispute about Tupac. “They’ve started describing the situation as ‘assault with a deadly weapon,’ ” rather than the standard gun possession, Slattery said. Also, Lil Xan had used the N-word. “Pardon my ignorance,” said Mira Carbonara, Spotted’s VP of commercialization. “Little whatever-his-name-is? Is he African-American?” He is not, but the ethnicity of the victim was unknown. They agreed to log it as a “hidden risk” for future racism.

In other news, Kim Kardashian was going to sponsor ride shares to ferry former prisoners to job interviews. It would be logged as a “cause,” a positive attribute, but was it also “politically outspoken,” a risk? Carbonara decided to split the difference; it was both a risk and an asset. Also on the agenda: The website All About the Tea had published seedy texts sent by former baseball player Jim Edmonds to a woman not his wife. “I wanted to add ‘sending explicit text while in a marriage/relationship’ as a guideline to our current infidelity classification,” said Slattery. There was also the fact that “his penis and etc. are in the photos. Would we want to include the tag of ‘leaked nude photos’?” Spotted usually applies that term to photos leaked by the celebrities themselves, but the team agreed that a dick pic is a dick pic.

Edmonds’s behavior would be logged in Spotted’s database, which includes nearly 27,000 public figures, each correlated with 224 attributes and risk factors. And though the discussion often sounded like a TMZ staff meeting, these assembled gossips were doing the work of actuaries. Later this summer, Spotted plans to sell “disgrace insurance” to entertainment companies and commercial brands, making the risk of celebrity downfall as quantifiable and reimbursable as that of floods and car crashes.

Celebrity scandal is as old as the tabloids, but the type of protection Spotted will offer was hardly used even a decade ago. Under the studio system, the financiers were in control — their stars’ transgressions easier to cover up, their contracts easier to tear up. True outrages like the Fatty Arbuckle case were relatively rare, and when they happened, the machine smoothed things over and rolled on. But today’s stars are the machine, commanding millions in endorsement deals and the lion’s share of indie-film budgets and carrying billions in market value on the backs of their reputations.

Those reputations, meanwhile, are increasingly fragile. Ubiquitous video and social media, supercharged by #MeToo, have led to a proliferation of high-profile disasters — Miramax’s implosion, Kevin Spacey’s erasure, Roseanne without Roseanne — leading producers and brands to look for new ways to mitigate the risks of reputational collapse. Studios have hired risk managers, dug deep into stars’ backgrounds in search of red flags, and added “morals clauses” to contracts. They’ve also been asking around about insurance.

If SpottedRisk’s product takes off, it will join a small but growing industry of disgrace insurers. Like other new types of insurance (terrorism, cyberattack, active shooter), Spotted’s disgrace innovation reflects what we fear most in the 21st century. In this case, it’s the persistent, growing dread that a career-ruining fall from grace is always just a click away.

Things were going so well for All the Money in the World, a big Christmas Week release from pop auteur Ridley Scott starring Mark Wahlberg and Michelle Williams. Kevin Spacey was the ace in the hole as J. Paul Getty, the mogul who refused to pay ransom for his kidnapped grandson, raising the question, When you can buy anything you want, what is the price of a human being?

In the case of Spacey, it was at least $10 million. On October 29, 2017, Anthony Rapp* alleged that the House of Cards star had made a sexual advance on him when Rapp was 14. Multiple accusers came forward over the next few days, and Scott and his financiers had to make an impossible choice: replace Spacey with another actor or risk box-office annihilation. The movie might ultimately live or die on Oscar nominations, and an Academy newly radicalized by the Harvey Weinstein allegations wasn’t about to reward a Kevin Spacey project.

By November 8, the financiers had decided to shoot the 87-year-old Christopher Plummer in Spacey’s role. That meant nearly two weeks of costly reshoots, extra fees for the other stars, at least a few hundred thousand for Plummer, and overtime for the crew and editors working nonstop — adding up to a quarter of the movie’s original $40 million budget, according to a report in Variety. And they would have to reassemble it all a month before the film’s release date.

This wasn’t the first time the loss of an actor had resulted in cost overruns and delays. It wasn’t even the first time for Scott, who’d had to work around the death of Oliver Reed on Gladiator. But death and disability have been covered by standard production insurance for decades with payouts that can easily exceed $100 million. Since Spacey wasn’t disabled or dead, but disgraced, the production picked up every penny of the tab.

Disgrace-insurance policies have existed since the 1980s; they arose as a category of contingency insurance (i.e., insurance against rare events) just as celebrity endorsements were transitioning from cheery ads with congenial father figures like Wilford Brimley to multiyear, multimillion-dollar contracts with megastars — Michael Jordan, Tiger Woods. Lloyd’s of London, the powerful insurance marketplace known for covering highly specialized risks (Dolly Parton’s breasts, a competition to find Bigfoot), put together the occasional high-limit disgrace package into the tens of millions. (In 2006, when Hannah Montana premiered, a clothing manufacturer took out a policy on its teen star, Miley Cyrus, in case any misbehavior affected sales.)

Most policies were much smaller, though, with limits rarely exceeding $5 million, and were worded so broadly it was almost impossible to get a payout. “I can’t think of a claim that was paid,” says Ringo Thompson, a London broker who has been selling entertainment insurance for three decades.

A standard Lloyd’s contract defined disgrace in vague terms — as “any criminal act, or any offence against public taste or decency … which degrades or brings that person into disrepute or provokes insult or shock to the community.” Most effective policies rely on precise terms and evidence that both sides can agree on — the Richter scale, a hospital bill. Subjective wording leads to disputes. Insurance “has to involve no litigation,” says Bill Hubbard, CEO of the entertainment insurer HCC Specialty Group. “You know the Supreme Court justice who said, ‘I know pornography when I see it’? You can’t settle claims that way.”

The contracts were much clearer on the definition of what didn’t merit a payout: Many of them exempted non-felonious offenses and acts committed prior to the policy’s start date. Even if the All the Money producers had bought a policy, Spacey’s past transgressions might have been excluded, treated as preexisting conditions.

While these limitations kept the industry small, the foibles of the rich and famous only increased demand for a better product. Tiger Woods’s 2009 car crash, followed by revelations of his infidelities, cost him $22 million in contracts with brands like AT&T and Gatorade — which was nothing compared to what they cost the companies. A UC Davis study put the brands’ shareholder losses somewhere between $5 billion and $12 billion.

But it wasn’t Woods who made disgrace insurance look viable; it was reality television. A few months before the golfer’s car crash came what one underwriter refers to only as “that Viacom loss.” Ryan Jenkins, then a contestant on the VH1 reality show Megan Wants a Millionaire and the star of an upcoming season of I Love Money, became the lead suspect in his wife’s murder and killed himself a few days later. Megan was canceled after three episodes and the Money season shelved entirely, costing Viacom seven figures in losses. That’s when the company started buying disgrace insurance.

Thousands of reality shows have been insured in the ensuing decade, many of them via two insurance brokers, Gallagher Entertainment and HUB International. HUB’s managing director, Bob Jellen, can recall about half a dozen claims paying out since the Jenkins murder. He wouldn’t offer specifics, but others have given two examples: P.I. Moms, which was canceled in 2011 following fraud and drug charges, and Spike TV’s Bar Rescue, after an owner killed a country singer in his own rescued bar. “It’s something we don’t advertise,” says Jellen of disgrace insurance. “You don’t have to sell people on disgrace.”

That seems true of unscripted shows, a thriving corner of the disgrace business. Their relatively low budgets and interchangeable talent make them easier to cover, and since reality contestants are often hired because of their wild behavior, the chance of a show-ending incident is definitely nonzero. The risk is high enough to boost demand, but the casts are large enough — and predictable enough in the aggregate — to entice insurers.

But for bona fide stars on scripted shows (as well as tours and brand endorsements), the underwriters and the financiers have had a harder time finding terms they could agree on, even as scandals have multiplied. The stakes are higher, the casts smaller, and the costs of a celebrity meltdown more difficult to predict. It’s also an issue of scale: When only a handful of shows and movies are asking for disgrace insurance, the few that aggressively seek it out make insurers suspicious about what producers know. Weather insurers can rattle off the chance of rain on any given date in northern New England, actuaries calculate life span down to the month, and car insurers know red Corvettes cost lives. All of them know more than their clients. But what does an underwriter know about Mel Gibson’s history that Mel Gibson’s agent doesn’t?

Nearly every insurer I spoke to reported increased interest in disgrace after Weinstein’s fall, and every single one explained why they couldn’t convert that interest into a market. The newly heightened risk of a cancellation, the reason more companies are looking into disgrace insurance, has made underwriters wary of crafting the kinds of policies — low premiums, clear terms, high payouts — that producers would actually want. “There’s all this demand,” says HCC’s Hubbard, “but there hasn’t been a viable product.” SpottedRisk thinks it has found the solution, which happens to be a popular one among start-ups: data.

Spotted knows about Mel Gibson’s history, and it claims to know exactly how risky that makes him. “The highest predictor of future disgrace is occurrences of past disgrace,” said Nicholas Hanes, Spotted’s first underwriter. Before taking the job in April, Hanes had worked for the insurance company Beazley, where his specialty was weather insurance, which he considers oddly apropos. Spotted’s deep analytics, he said, “are the rain data; they’re the flood maps.”

When we met in the Spotted office, I was the one who made a comparison between climate change and the social-media maelstrom of our lives, but Hanes picked it up with enthusiasm. “You go back to the earliest of Hollywood tabloid scandals and there’s always been disgrace events,” he said — but for decades, they were relatively sparse and easily buried. What has changed is “the severity and randomness of it all.” The recent spate of category-four Kevin Spaceys parallels the sudden prevalence of hundred-year floods — never mind the utterly unprecedented events, evidence of a world out of whack. “Something like the college-admissions scandal: That is a snowstorm in California in June.”

Spotted aims to make disgrace at least as predictable as the weather. The company’s model relies on two key scores, both ranging from 0 to 100: a risk score and a reaction score in the wake of a disgrace, the latter of which maps onto a patent-pending Public Outcry Index. Just like flood maps or a 21-year-old’s chances of crashing a car, the risk score helps set the premium. And just like the Richter scale or tornado categories, the Outcry Index sets the payments.

Spotted outsources its risk-data collection to India, where workers scan celebrity gossip and send reports to analysts in Boston, who organize and relay the information to data scientists for algorithmic tweaking. And it is working with Lloyd’s, whose investors will be backing the payouts, to set limits around $10 million and premiums somewhere between .7 percent and 2 percent (so up to $200,000). That’s within the normal range for catastrophic insurance. (Brand sponsors are expected to opt for lower limits than Hollywood producers.)

All of this is new both for disgrace insurance and for SpottedRisk, a company that Janet Comenos, its 33-year-old CEO, founded less than four years ago as Spotted, Inc. Over an outdoor lunch a block from her Back Bay office, Comenos narrated her business trajectory in a flurry of tech buzzwords. After the University of Pennsylvania, she worked on a trading floor before going into start-ups, first at a mobile-ordering company called LevelUp, then at Promoboxx, which uses digital marketing to help align brands with local retailers. “It wasn’t the most exciting thing,” she said. During sales calls, she developed “a nervous tic”: constantly refreshing Perez Hilton’s website for celebrity gossip.

Before long, Comenos found a way to turn her compulsion into a start-up of her own. She teamed up with Dana Lampert, who had founded an education-software company in college and sold it in his 20s. Lampert was fascinated by the sports side of celebrity, particularly the data side of the sports side. What Billy Beane did for baseball, Lampert wanted to do for fame — Moneyball it. He came up with a system for tagging everything a famous person was caught wearing in paparazzi shots, from the designer kaffiyeh down to the limited-run Yeezys. In homage to those brands that inundate journalists’ in-boxes with subject lines like “Tinsley Mortimer spotted wearing Swarovski,” they called their company Spotted, Inc.

“We found a gap where a lot of celebrities were using brands naturally in their everyday lives,” said Lampert. “We became interested in how we could leverage or utilize those endorsements.” The idea was to feed the information back to the brands, monetize the influencers, and take a cut. They hired a behavioral scientist, Steve Hutchinson, who’d recently earned his Ph.D. by studying how stress affects learning. He wasn’t so much into celebrity, but, as he told me, “it was such a cool data set.”

That was “two pivots ago,” as Hutchinson put it. Spotted soon became a matchmaking service, using the data it had collected to try to rationalize the endorsement process. The company signed up Nike, Neiman Marcus, and H&M. But it turned out that brands didn’t really want to be told which stars best suited their image. “The brand would ask us to look at a list of five or ten people,” said Comenos. “Our scores would show that the majority, if not all of them, scored really low in terms of trust and likability and appeal with the brand’s target customers.” The recipients of those reports weren’t grateful; they “were pissed off.” They felt second-guessed.

Eventually, Comenos turned for advice to an ad veteran, Sir Martin Sorrell. Sorrell had recently resigned from the advertising juggernaut WPP, reportedly after it was discovered that he had visited a brothel on the company dime. (He has publicly denied it.) Perhaps out of a fresh appreciation for the fallout from disgrace, he told her she’d have much more success by playing to advertisers’ fears: “Focus on the risk.” Comenos decided to pivot again.

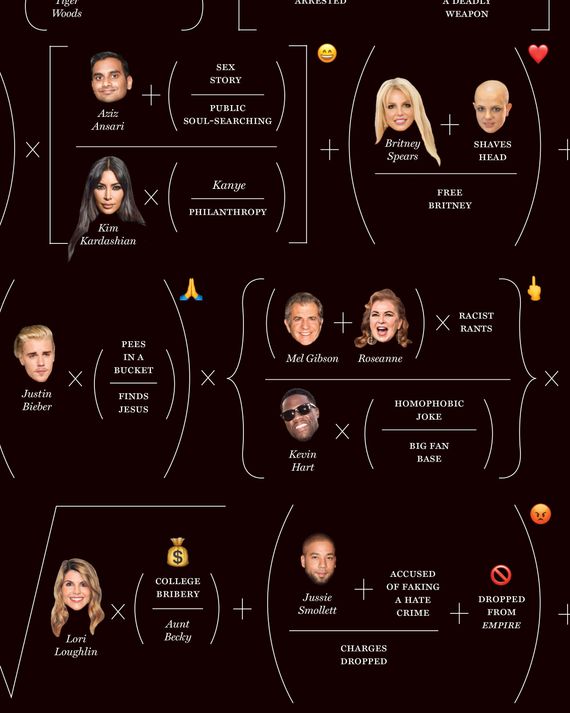

Hanes is the current co-president of the North American Contingency Association. In May, his new boss headlined its annual conference for the public debut of what was now rebranded as SpottedRisk. Comenos took the stage wearing a Britney Spears concert T-shirt and laid out some of the behaviors tracked by Spotted: public intoxication, cultural insensitivity, child pornography, animal abuse, gang affiliation, bribery, physical attacks, ethnic discrimination, racially charged commentary, cocaine possession, bullying, extortion, sexism, DUI, tax evasion, sexual assault, possession of a deadly weapon, ageism, transphobia, child negligence, arson, child abuse, solicitation, body shaming, infidelity, and bankruptcy. She cited Spotted data showing a 29 percent increase in disgraceful events from 2017 to 2018 — despite which only 1 percent of productions bought disgrace insurance. She got a laugh when she said, “Males tend to be a little riskier overall, not surprisingly.”

According to Spotted, all kinds of things make one celebrity riskier than another. Firstborns are at slightly higher risk of disgrace, as are those under 35 or who’ve suffered recent breakups — until the passage of time sends the bereft partner back down the “risk-decay curve.” But behaviors are far more important than demographics. Mishaps needn’t be catastrophic events; drunk driving looms large because it signals “poor impulse control and emotion regulation,” according to Pete Dearborn, Spotted’s second behavioral scientist. (Comenos calls him and Hutchinson “the Doctors of Disgrace”.) Another risk is association — the kind of company that, say, Hailey Baldwin keeps (husband Justin Bieber, for one). Often it comes down to finding not a skeleton in a closet but a trail of half-buried bones.

Mitigating the risks are seemingly fuzzier factors such as “likability” and “resilience.” Sometimes positive behaviors can help people bounce back (as they did for Aziz Ansari, whose sensitivity and self-questioning have raised his “trustworthiness” 13.38 percentile points since he was accused of sexual aggression). Other times, it’s beyond their control. Spacey may have been doubly doomed because he has played so many bad characters. “Individuals who play villainous roles are not forgiven at as high a rate,” said Comenos.

She didn’t mention Spacey’s sexuality. Spotted has, for now, excluded “protected class” attributes from its model, avoiding the most blatant kinds of profiling (though it does track education levels and other proxies for class). But here is the controversial, incontrovertible fact of disgrace insurance: It is not a moral arbiter of behavior but a reflection of society’s tolerance of it. Spotted aims to quantify our standards, which are never as immutable as we think they are. Disgrace has always been subjective; that’s why past policies have been constructed so vaguely.

And that is why the Outcry Index is arguably more important than the risk score. (It’s also the one Spotted was more willing to share; the company felt that releasing celebrities’ risk scores could be libelous.) After a disgrace event, the Boston data team writes about 25 questions testing the public’s recall of and reaction to the scandal and sends them to Kantar, a research firm that conducts online polls on days one, four, seven, and so on. Data is collected for 30 days, though the claim is triggered after a week. The results fall into one of five tiers, each of which pays out at 20 percent: A Tier 1 event pays $2 million on a $10 million policy, while a Tier 4 pays $8 million. This set of what the industry calls “parametric triggers” is common for measurable events like earthquakes and hurricanes but is new to disgrace.

All those numbers don’t necessarily add up to a real policy; data may make a big impression among venture capitalists, but the proof will be in the payouts. In order to demonstrate the viability of the product to the investors at Lloyd’s, Spotted has run giant simulations on disgrace events over the past year, creating a sort of alternate universe in which the entire entertainment industry carried its insurance. In its models, Felicity Huffman’s disgrace was only a Tier 1, meriting $2 million, while Lori Loughlin’s was a Tier 2 (not as likable/popular; she didn’t apologize). The documentary Surviving R. Kelly triggered a Tier 3, but then Kelly’s February arrest promoted him to Tier 4. Jussie Smollett was only a Tier 1 because the allegations were murky in the public’s mind. Louis C.K. was a 2; Roseanne Barr and Matt Lauer were 3’s, Spacey a 4. The $10 million jackpots, the Tier 5’s, were paid out by the fictional insurers of Bill Cosby and Harvey Weinstein.

You learn things about people from data like this. Certain celebrities are Teflon. Chris Brown, despite 40 prior disgrace events, remains insurable — at least for Spotted. The data also found that social-media outrage doesn’t always reflect broader attitudes. “One of the reasons that we rely on the survey data is that we’ve done tons of testing of social media,” said Dearborn. “Almost every single event looked like it was a world-ending event. The internet just does not react to things in the way that humans do.” Barr is the rare exception, having spawned equivalent outrage on Twitter and IRL.

The survey results have left Spotted’s Doctors of Disgrace with a view of the public as fairly forgiving. Hutchinson presents Liam Neeson’s controversial anecdote about wanting to kill a “black bastard” as evidence. “The severity wasn’t nearly as high as you’d predict,” he said. The public was well informed of mitigating factors (his friend had been raped; this was far in his past). It turns out that the vox populi is capable of nuance.

The only celebrity anyone at Spotted declared essentially uninsurable was Kelly. As for Donald Trump, Dearborn said, “he would probably trigger a claim every week,” simply by existing. “Some people are basically human triggers.”

True to its roots in paparazzi sightings, Spotted plans to capitalize on the pop appeal of its insurance when it writes its first policy later this summer. There will be an ad in The Hollywood Reporter, reading, “HAVE YOU BEEN DISGRACED?” Comenos also showed me a dark presentation video set to the tune of Lou Reed’s “Walk on the Wild Side.” It starts with scrolling phrases (“WE TRACK WHERE THEY GO,” “WE TRACK WHAT THEY DO,” “WE TRACK EVERYTHING THEY DO”), followed by photos of Caitlyn Jenner’s transition, a long Britney Spears breakdown montage, some Full House deep cuts, and a triptych of snapshots of Amy Winehouse at her worst.

Before getting its underwriting license, Spotted had spent a few months looking to partner with existing insurers. Its more established peers are deeply curious about what it will produce, but skeptical that it will be quickly or broadly adopted. Hubbard, whose HCC Specialty was an early potential partner with Spotted, said he’s working on a different model, one that uses a sliding scale of disgrace, whereby a claim would be triggered by a set change from the policy’s start date. But he has no immediate plans and sees little urgency in competing over a product with no track record. “I’m not sure going second or third isn’t the best thing to do in product development,” he said. “It’s unlikely that someone is going to get it right the first time.”

Other experts were not convinced SpottedRisk could attract enough regular clients to create a stable risk pool. What makes their product fascinating — the novelty of the algorithm — might even put off potential customers, making disgrace insurance look like a luxury add-on without a proven track record rather than a necessity. It’s one thing to demonstrate demand, another to persuade an entire industry to create a new budget line item.

Another lingering problem is that $10 million still wouldn’t cover even a relatively modest indie film. Comenos hopes to push some limits up to $15 million on rare occasions, but unlocking significantly more will require a year of profitability, keeping payouts below 60 percent of the premiums she takes in. Even to secure $10 million, she has had to compromise on several features. She has scrapped plans for crisis-counseling services, which some believe might have been a more profitable use of the data. And her entertainment coverage will now require Hollywood to prove its losses — muddying her system of clear payouts and raising the risk of disputes.

Spotted plans to sell its insurance through traditional Hollywood brokers, including Gallagher Entertainment. When I asked its managing director, Brian Kingman, about whether he could sell Spotted to his clients, he seemed a little ambivalent. He didn’t think the lower tiers would cover enough of the losses. “We need more limit, but I think it’s a start.” He was still a little shaky on the specifics, suggesting that, a month before the planned rollout, Comenos’s drive to “educate the brokers” was still an ongoing process. Kingman is reasonably confident that, with hard data and Lloyd’s backing, the policies will work. What he’s not so sure about is that they’ll sell.

Comenos isn’t the type to wait to find out. The company has so far raised more than $11 million, roughly half of it from Boston private-equity firm Schooner Capital and most of the rest from Comenos’s friends and family. At an all-hands meeting the morning of my visit, she went over seven goals that needed to be met by the fall in order to lure Series B funding for the company’s next phase. Most of these, to my surprise, involved the launch of an entirely new class of products: “reputational insurance.” Like disgrace insurance, but for companies instead of people.

This new policy line — which has since been pushed back to early 2020 — would cover all risks to a company’s image, from cyberterrorism to product recalls to a CEO’s dismissal over expensing visits to brothels. It makes sense; one recent report found that reputational damage is the No. 1 risk that companies fear. Brands are less stable than they once were, with fewer in it for the long haul and more, like Spotted, eyeing what Comenos calls “a very sizable exit.” Companies now spend less than 20 years on the S&P 500, down from 60 in the postwar era. In a world where people are treated as brands and brands are increasingly treated as people, reputation is the most valuable commodity of all. So, Spotted hopes, is the information that can be gleaned and monetized in the service of protecting it. It could be a great new business opportunity — or, at the very least, a really cool data set.

*This story has been corrected to show that Anthony Rapp, not Adam Rapp, accused Kevin Spacey of sexual misconduct.

*This article appears in the August 5, 2019, issue of New York Magazine. Subscribe Now!