This story also ran in Buffering, Vulture’s newsletter about the streaming industry. Head to vulture.com/buffering and subscribe today!

When I saw a tweet Monday night reporting that season four of Yellowstone had opened to just north of 8 million viewers, my first thought was, Ah, the folks at Paramount Network PR did a good job hyping the Nielsen numbers. After all, the season three finale had notched 5.2 million viewers back in August 2020, and in this era of perpetual ratings decline — particularly in cable — such enormous year-to-year gains simply don’t happen anymore. Networks these days need to go to great lengths to spin their incredibly shrinking audiences, so I was pretty sure some trickery was involved. As it turns out, not only was the reported figure legit, it actually undersold the show’s performance.

If you include simulcasts of the premiere on three other ViacomCBS networks (TV Land, CMT, and Pop), Yellowstone’s Sunday audience was just shy of 10 million viewers. And if you throw in a few encores later in the evening on Paramount, it grows to 11.4 million viewers. These are stunning numbers, the best we’ve seen for any cable show since 2018 vintage The Walking Dead and a bigger same-day audience than just about every entertainment series on TV this year. But what makes them even more impressive is that they haven’t been padded by viewers from ViacomCBS’s Paramount+ or any other subscription streaming service because, just like FX’s Impeachment: American Crime Story, the only way to legally watch new episodes of Yellowstone as they debut is by having a cable subscription (including virtual cable platforms such as Hulu with Live TV) or purchasing them on iTunes and other digital stores. Because of a deal with Peacock announced early last year, there is no next-day streaming of Yellowstone outside of the aforementioned cable services. Unless you buy the show, it’s the bundle or bust.

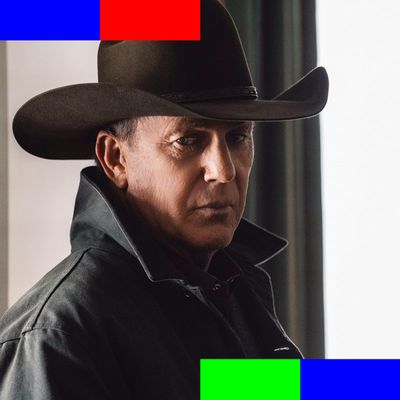

That Yellowstone is able to aggregate such a huge audience in one night without the benefit of an SVOD component underscores once again why it is a mistake to totally write off traditional TV, even as streaming is ascendant. There are still nearly 75 million U.S. households who pay for some form of cable, and while those homes are spending more and more time on streaming platforms, they keep showing time and again they’ll turn up for the right kind of program on a linear channel. And Yellowstone is exactly that: It’s genetically engineered to appeal to folks over 50, also known as the demo most likely to be able to afford a cable subscription. It also isn’t the kind of show critics or pop-culture writers go crazy over, the way they (okay, we) salivate over Succession. But in this case, that isn’t an issue: While Yellowstone actually gets a decent amount of press coverage (much more than the equally popular NCIS or Blue Bloods), its audience base doesn’t need to be activated by a New York Magazine cover story or a Kevin Costner meme going viral on TikTok. It doesn’t need an algorithm to recommend it check out a modern-day Dallas.

And yet even if Yellowstone is the very definition of an old school TV hit, there may also be a streaming component to its success. A show doesn’t basically double its audience within the space of a year without recruiting new viewers who’ve had time to catch up on earlier seasons. Clearly, many millions of people have done just that since August 2020, and while some no doubt relied on their cable company’s video on demand function, I’d be willing to bet more than a few did so via Peacock. The Comcast-owned streamer has made Yellowstone one of its tentpole library programs, heavily promoting it within its user interface and highlighting it in external marketing since launching nationally in mid-July 2020, a few weeks before season three of Yellowstone wrapped. While Peacock doesn’t have the reach of a Netflix or Hulu, it’s definitely grown its user base over the past 12 months, thus giving millions of consumers the chance to potentially get hooked on Yellowstone via a Peacock binge.

We have seen this pattern before, most notably with Breaking Bad. As I wrote back in 2013, multiple factors were behind the slow-motion success of AMC’s signature drama, but availability on the then-fledgling Netflix absolutely played a significant part in helping translate strong word of mouth for the show into viewers. And, it should be noted, Netflix back then only had about 25 to 30 million U.S. subscribers, which is right around the same number of active users Peacock currently boasts. Given Peacock has had several big audience draws in recent months, most recently including a day-and-date premiere of the latest Halloween movie, it’s not hard to imagine Yellowstone recruiting new eyeballs via its Peacock run. I emailed a Peacock rep to see if the service would share any information indicating Yellowstone was doing particularly well; unfortunately, a rep for the platform passed on the chance to praise the performance of its multimillion dollar acquisition. But I think there’s good reason to suspect the bird streamer played a not-so-small role in helping Yellowstone make the leap into the ratings stratosphere.

Meanwhile, as big a win as Yellowstone is for Paramount Network, its explosive growth once again raises the question of why parent company ViacomCBS opted to sell reruns to Peacock rather than keep the show in-house and stream it on Paramount+. Company execs have explained it as a call made before Viacom and CBS were fully united and the company’s streaming strategy was clear. But the merger of the two companies was already a foregone conclusion by the time a deal was signed in late 2019, and the whole reason for the union was to build a stronger streaming presence. I think Viacom execs simply chose to take the huge check NBCUniversal was willing to write for the show rather than spend a similar sum to ensure it stayed in the family. It took short-term profit over investing in the future of its own streaming play.

That decision has hardly been a disaster, of course. ViacomCBS is still making plenty of profit off the show, both because of Peacock money and ad sales. And the company is smartly spending some of that cash to create new spinoffs from the Yellowstone universe for Paramount+, including December’s 1883. Unfortunately, there’s no guarantee these new shows will be anywhere near as successful as the original (just look at the numbers for the various offshoots of The Walking Dead). And the fact is that the halo effect a big hit like Yellowstone would normally have on a cable network is being wasted at Paramount Network. There are literally no other scripted original series on the channel right now; it’s just reruns and movies. And while in theory a hit like Yellowstone would get cable operators to pay more for Paramount, the channel’s lack of other original content more than cancels out those gains. Quite frankly, I don’t understand why ViacomCBS CEO Bob Bakish didn’t decide months ago to move Yellowstone to CBS. As massive as its ratings are on cable, it would be an even bigger smash on the Eye network, where it could also serve as the lead-in to any of a number of other new and returning shows.

Point-Counterpoint: The Curious Case of Impeachment

Another interesting component of Yellowstone fever is that its season four success comes just as there’s been some media industry debate about whether Impeachment’s aforementioned absence from FX on Hulu has hurt the latest installment of the Ryan Murphy anthology series. I am guilty of advancing at least a version of this theory: When Washington Post politics ace Dave Weigel tweeted that the show had all but disappeared from the Zeitgeist, I chimed in that being excluded from subscription streaming might have limited its pop culture resonance: “This is what happens when a show airs cable only and doesn’t at least stream next day on a major SVOD platform.” Within a few days, the New York Times was out with a story pretty much declaring the same thing, though it took the idea further by also implying Impeachment’s ho-hum ratings were connected to not being on a streamer.

I obviously don’t disagree with the first part of the argument. Like HBO, FX runs on critical acclaim and the enthusiasm of elite audiences, particularly those under 40, and if a show is stuck in the cable universe, it’s much, much harder for it to break out in 2021. (I believe the final season of Pose suffered from a similar issue.) But while not being available on the preferred platform of influencers may limit discussion, it has next to nothing to do with how a show performs in the ratings, as Yellowstone’s eye-popping numbers make clear. It’s always dangerous to make definitive declarations about why a project underperforms, but it seems more likely that Impeachment is doing so-so linear numbers because, despite an amazing cast, it’s still about a nearly 25-year-old political scandal (as opposed to senational murder cases involving an O.J. Simpson or Gianni Versace, like past ACS installments) and it doesn’t feature a movie star as beloved as Kevin Costner.

One last thing: While Impeachment may not be setting the world on fire during its initial run on FX, remember it will get a second life sometime next year when it comes to Netflix. Time and again, we’ve seen titles languish on linear and then catch fire when they land on the streaming giant. (NBC’s Manifest is just the latest example of this.) Throw in an aggressive Emmy push for the show from FX and it would not at all shock me to see the project return to the cultural conversation in a big way.

Disney+’s Ups and Downs

It’s a big week for Disney’s streaming empire. Tomorrow is the company’s self-proclaimed Disney+ Day, where nearly every corner of the Mouse House empire will be filled with marketing and promotion of the streaming service. And much like Netflix’s recent Tudum event, you can expect a ton of trailers, teasers, and assorted morsels of content to start populating your social media feeds throughout the day Friday. It’s all a big marketing stunt designed to get current subscribers streaming more content, and just as importantly, to get more people to sign up for Disney+ in the first place. After Thursday’s Walt Disney Co. earnings report, it is clear Disney+ could use the boost.

After a very strong spring, the service added a modest 2 million net subscribers between July and September, bringing its global base to a hair over 118 million. While any streamer not named Netflix would kill for that many customers, some particularly rosy analysts had been projecting Disney+ would end the quarter with more than 125 million subscribers, per The Wall Street Journal. And the 2 million net marks the weakest quarter yet since Disney+ kicked off two years ago this month. In other words, it was a cruel summer (or is that a Cruella summer?) for the Disney streamer. The company’s stock took a predictable dive in the wake of the news.

While Wall Street was disappointed by the D+ data, I don’t think it should be shocking that growth for the service slowed a bit during the summer. While the Delta variant put a crimp in a lot of folks’ plans, in many places around the world, summer and early fall felt a bit more like normal for the first time in two years, making signing up for a streamer less of a priority. But more crucially, Disney+ still isn’t adding big new content as regularly as many of its biggest rivals. There hasn’t been a big Marvel or Star Wars live action show since Loki (which premiered in the second quarter) and Disney didn’t make any of its big feature films available on Disney+ over the summer (subscribers had to pay extra).

The good news for Disney is that the tsunami of new content green-lit at the end of 2020 will start flooding into Disney+ in 2022. If and when the service gets to the place where there’s a major new release every week or two, I think there’s good reason to believe subscriber growth will start picking up again.