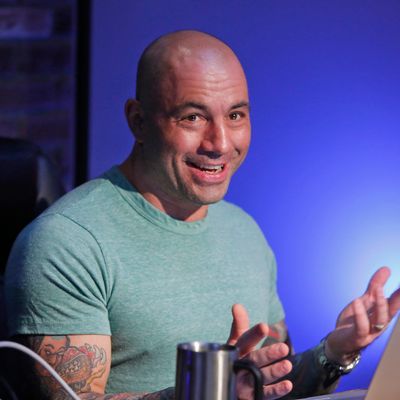

In a sense, we’ve come full circle. Sort of. Last Friday saw the announcement that Joe Rogan is staying with Spotify, striking a new partnership with the platform and resolving a question that’s been the source of some hubbub going into the year. The Wall Street Journal was first to break the news, reporting that the multiyear deal is thought to be valued up to $250 million via some combination of minimum guarantee payments plus a cut of the advertising revenue.

It’s worth placing the size of this deal in context. Today’s Spotify is one trying to practice what market analysts like to euphemistically call “cost discipline” after years of splurging backfired when the broader financial picture turned sour; recall the multiple rounds of layoffs last year, new talent deals being smaller and controlled for risk (as with the case of Trevor Noah), and the general disinvestment from anything resembling original work. This is also a Spotify on the back foot, one that’s flailing about for opportunities while trying to keep those costs down: audiobooks, video, AI. Rogan almost certainly had all the leverage going into renegotiation. And notably, the new deal isn’t a continuation of the status quo. The Joe Rogan Experience will no longer be exclusive to Spotify as part of the updated arrangement. It will soon appear across all platforms, including YouTube, which is increasingly being considered a podcast distributor.

If you’re wondering what’s in it for Spotify without the exclusivity, the answer is, well, still quite a lot. Being what’s widely assumed to be one of the largest podcasts in the world — if not the largest — The Joe Rogan Experience remains a huge engine that would help Spotify in a few different directions. Obviously, it will generate advertising revenue, and cash is good for Spotify now that tech companies have to actually prove they can be profitable. It will keep advertisers excited to talk to Spotify about Megaphone, its podcast-hosting and monetization platform that’s become central to paying off the huge bet they placed on the category over the past few years. The Joe Rogan Experience will also continue to play a big role in Spotify’s pivot to video, which remains haphazard; the platform seems to want to both build out its own in-app video experience while making money off partners like The Joe Rogan Experience by helping monetize it on YouTube.

The same logic applies to the other big Spotify content news in recent weeks: the announcement that audio episodes of Call Her Daddy, another blue-chip asset in Spotify’s portfolio, will no longer be exclusive to the platform. (However, the video versions of that show will still be exclusive to Spotify’s video experience. Like I said, it’s haphazard.) Technically, Call Her Daddy isn’t the last of the Spotify-exclusive podcasts; the platform still has some original productions behind the wall, including its IP-dabbling audio drama Batman Unburied, and a spokesperson told me that the company is “evaluating plans to roll out other shows on a case-by-case basis over time.” But the big partnerships like Rogan and Call Her Daddy are the ones that define Spotify’s nonmusic business, and both going wide effectively ends Spotify’s foray into a platform-exclusive strategy, which will leave behind a very mixed legacy at best.

On the one hand, I’ve heard plenty of industry types argue that pursuing exclusives was the very reason Spotify can claim to have overtaken Apple in terms of podcast listenership. On the other hand, if that’s the victory, it’s a Pyrrhic one. That’s a lot of cash and bodies it burned through, and not to mention goodwill, to the extent that matters. Furthermore, exclusivity almost certainly prevented many of its shows from getting a fair shot at building an audience that could’ve helped justify their existence. It’s even strongly believed that The Joe Rogan Experience’s own audience took a hit due to exclusivity, at least initially, though that notion is often disputed; the best anyone could prove the theory was through indirect measures, as was the case of this 2021 effort by the Verge.

What a difference a bust cycle makes. When Spotify’s original Joe Rogan deal was first announced back in 2020 — several months into the pandemic, when the podcast market was frothy and bumping — a chief executive of a podcast company texted me “game, set, match,” expressing what became a prevailing sense that the Swedish platform had gotten an insurmountable leg up on everyone else. That was three years, a global pandemic, multiple Rogan controversies (oh, right, this is an election year), a faux-cession, several interest-rate hikes, and a brutal stretch for podcasting ago. I’m pretty sure the executive who sent me that text is no longer in the business.

Spotify turned out to barely have a plan, and looking back over the past few years, it seems like the grand podcast future the platform helped usher in is one that ultimately looks a lot like the past. By this I mean an ecosystem that, on the upper echelons at least, basically looks like old-school radio — a sense further underscored by the other other big podcast news that Smartless, the wildly popular Jason Bateman–Will Arnett–Sean Hayes celebcast, is moving from Amazon to SiriusXM for $100 million, per Bloomberg. “It’s starting to shake out in a reminiscent way of terrestrial radio and some other things,” said the satellite radio company’s chief content officer, Scott Greenstein, in a recent investor call. Hard to dispute that.

But when I say podcasting these days has started to look like what it did in its earlier years, I’m also referring to how wide swaths of today’s podcast mainstays are broadly the same as in the late 2000s: chat shows, iterations of what you’d find on broadcast radio, Rogan. (And Bill Simmons, and Marc Maron … and even Roman Mars. They’re all still here!) Perhaps most importantly, the push toward walled gardens has been abandoned for now, with podcasting swinging back to open publishing. This is an unalloyed good, because it means no one player can structurally control the space. At the end of the day, Spotify plowed through so much money to get ahead, only to seemingly end up right next to SiriusXM.